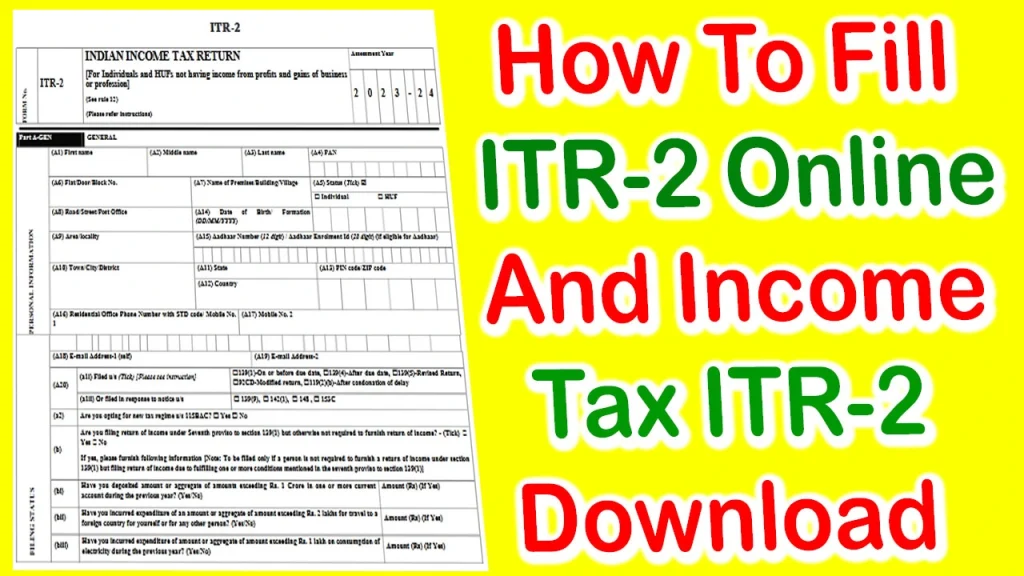

ITR 2 Form Download PDF, How To Fill ITR 2 Form Online, ITR 2 Form Download, ITR 2 Form PDF, ITR 2 Form Download In Hindi, ITR 2 Form, ITR 2 Form PDF, Itr 2 form download excel, itr 2 form for ay 2023-24, itr-2 filled form example pdf, Download itr 2 form, ITR 2 Form Eligibility, Download PDF Format ITR 2, How To Download ITR 2 Form, How To Fill ITR 2 Online, Income Tax ITR 2 Form PDF

ITR 2 Form Download PDF : The pre-filling and filing of ITR-2 service is available to registered users on the e-Filing portal. This service enables individual taxpayers and HUFs to file ITR-2 through the e-Filing portal. This user manual covers the process for filing ITR-2 through online mode.

ITR 2 Form Download PDF 2023-24

Income tax is a crucial part of every citizen’s financial responsibility, and it is essential to file your taxes correctly and on time to avoid any legal issues or penalties. In India, the Income Tax Department has simplified the tax filing process by introducing various Income Tax Return (ITR) forms, each designed for different types of income and taxpayers. In this comprehensive guide, we will delve into the details of ITR-2, focusing on how to download the ITR-2 form in PDF format and how to file your taxes using this form.

What is ITR-2?

ITR-2 is one of the many forms provided by the Income Tax Department of India for filing income tax returns. It is primarily used by individuals and Hindu Undivided Families (HUFs) who have income sources other than business income. ITR-2 is meant for individuals and HUFs who have income from:

- Salary or Pension

- House Property

- Capital Gains

- Other Sources (including lottery winnings, family pension, etc.)

- Foreign Assets or Foreign Income

If you fall into any of these categories, you should consider filing your taxes using ITR-2. However, it’s important to note that if you have income from a business or profession, you should use a different form, such as ITR-3 or ITR-4.

Why is ITR-2 Important?

Filing your income tax return accurately and on time is not just a legal obligation but also an essential financial practice. Here are some key reasons why ITR-2 is important:

- Legal Compliance: Filing your income tax return is mandatory if your income exceeds the prescribed threshold. Failure to do so can result in penalties and legal consequences.

- Claiming Refunds: If you have paid more taxes than you owe, filing an income tax return, especially ITR-2, allows you to claim a refund. This is particularly important if you have made significant investments or have TDS (Tax Deducted at Source) deductions.

- Financial Record: Filing your income tax return provides a clear record of your income and tax payments. This can be useful for various financial purposes, including applying for loans, visas, or immigration.

- Avoiding Scrutiny: Filing your taxes accurately reduces the chances of being selected for a tax audit or scrutiny by the tax authorities.

Now that you understand the importance of ITR-2, let’s proceed to the steps involved in downloading the ITR-2 form in PDF format.

ITR 1 Form Download 2023-24

ITR 7 Income Tax Form PDF Download

How to Download ITR-2 Form in PDF?

Downloading the ITR-2 form in PDF format is a straightforward process. Follow these steps to obtain the form:

Step 1: Visit the Income Tax Department’s Official Website

To download any income tax form, including ITR-2, you need to visit the official website of the Income Tax Department of India. The website URL is https://www.incometaxindiaefiling.gov.in/.

Step 2: Register or Login

If you are a first-time user, you will need to register on the website using your PAN (Permanent Account Number) as your user ID. If you are already registered, you can simply log in using your credentials.

Step 3: Navigate to the ‘Downloads’ Section

Once you are logged in, navigate to the ‘Downloads’ section on the website. You can usually find this section in the top menu or the left sidebar.

Step 4: Select the Assessment Year

In the ‘Downloads’ section, you will find a list of income tax forms for various assessment years. Select the appropriate assessment year for which you want to file your tax return. For example, if you are filing your return for the financial year 2022-2023, the corresponding assessment year would be 2023-2024.

Step 5: Choose ITR-2

Scroll through the list of forms until you find ‘ITR-2.’ Click on the link to download the form in PDF format.

Step 6: Download the PDF

Once you click on the ITR-2 link, the PDF file will start downloading automatically. Depending on your browser settings, you may be prompted to choose a location to save the file.

Step 7: Verify the PDF

After downloading the ITR-2 form in PDF format, it’s essential to verify that you have the correct form for the chosen assessment year. Ensure that all the pages and sections of the form are present.

That’s it! You have successfully downloaded the ITR-2 form in PDF format, and you can now proceed to fill it out and file your income tax return.

Income Tax Form 29b PDF Download

Income Tax Form 3ceb Download PDF

How To Fill ITR 2 Online

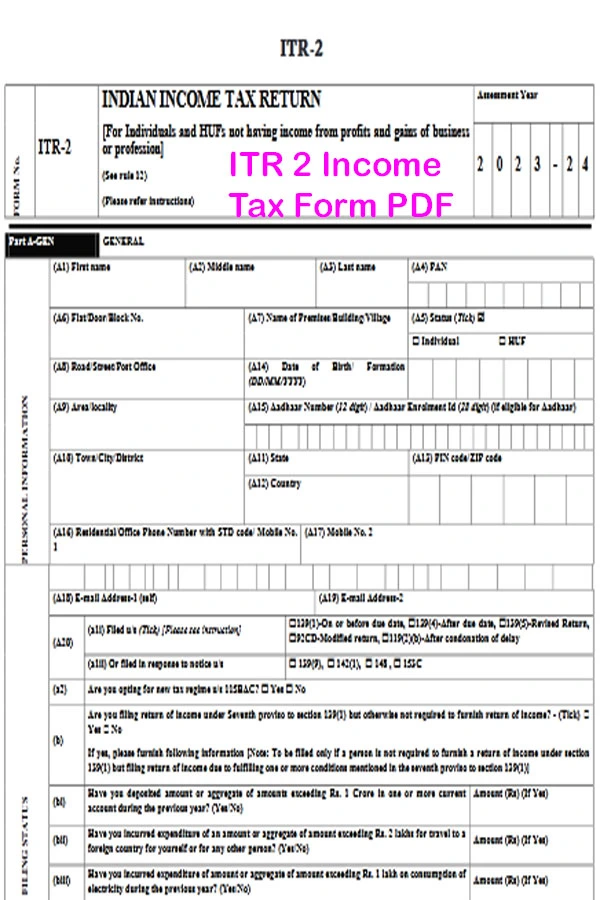

Filling out the ITR-2 form can be a bit complex, especially if you have various sources of income or foreign assets. Here are some key sections of the form and tips on how to fill them:

- Personal Information: Provide your personal details such as name, PAN, Aadhaar number, and contact information accurately.

- Income Details: Enter details of your income from various sources, including salary, house property, capital gains, and other sources. Be sure to fill in all the required fields and double-check the figures for accuracy.

- Tax Computation: Calculate your total income, deductions, and taxable income. Use the appropriate sections of the form to claim deductions under various sections of the Income Tax Act, such as Section 80C, Section 80D, and so on.

- Foreign Assets and Income: If you have foreign assets or foreign income, you must provide details in the relevant sections of the form. Ensure compliance with the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) if applicable.

- TDS and Advance Tax: Report any TDS deducted from your income by your employers or other entities. Ensure that you have the necessary TDS certificates to support your claims.

- Verification: Sign and verify the information provided in the form. You can e-verify your return using options like Aadhaar OTP, net banking, or sending a signed physical copy to the Centralized Processing Center (CPC).

- Additional Schedules: Depending on your income sources, you may need to fill out additional schedules that accompany the ITR-2 form. These schedules provide a detailed breakdown of specific income categories.

How To Download ITR 2 Form PDF

ITR 2 Form Download Link – Download ITR-2 PDF

Filing Your Income Tax Return

Once you have filled out the ITR-2 form correctly, you can proceed to file your income tax return. Here are the steps to file your return:

- Review the Form: Before filing, carefully review all the information you have entered in the form. Check for any errors or omissions.

- Save a Copy: Save a copy of the filled-out ITR-2 form on your computer or in cloud storage for future reference.

- File Online: You can file your income tax return online through the Income Tax Department’s e-filing portal. Upload the XML file generated by your tax preparation software or fill out the form online.

- E-Verify or Send Physical Copy: After successfully filing your return, you have the option to e-verify it using methods like Aadhaar OTP, net banking, or sending a signed physical copy to the CPC.

- Acknowledgment: Once your return is filed and verified, you will receive an acknowledgment. Keep this acknowledgment for your records as it serves as proof of filing.

- Verification Status: You can check the status of your e-verification on the e-filing portal to ensure that your return has been processed.

Form 15CB Income Tax PDF Download

How To Fill And Download Form 29C Income Tax Online

Tips and Precautions

While downloading, filling out, and filing your ITR-2 form, here are some important tips and precautions to keep in mind:

- Use the Correct Assessment Year: Ensure that you download the ITR-2 form for the correct assessment year corresponding to the financial year for which you are filing your return.

- Keep Records: Maintain detailed records of your income, deductions, and supporting documents. This will help you fill out the form accurately and provide evidence in case of any scrutiny.

- Seek Professional Help: If you have complex financial situations, foreign income, or are unsure about certain aspects of the form, consider seeking assistance from a qualified tax professional.

- Be Timely: File your income tax return well before the due date to avoid penalties and interest on late filing.

- Regularly Update Aadhaar and PAN: Ensure that your Aadhaar and PAN details are up-to-date and match with each other to avoid any discrepancies during e-verification.

Conclusion – ITR 2 Form Download PDF – How To Fill ITR 2 Form

ITR 2 Form Download PDF – Filing your income tax return is an essential financial responsibility that every taxpayer in India must fulfill. ITR-2 is the form of choice for individuals and HUFs with income from various sources, including salary, house property, capital gains, and foreign assets or income.

Income Tax Form 15CA Download PDF

How To Download Income Tax Form 9 PDF Online

By following the steps outlined in this comprehensive guide, you can easily download the ITR-2 form in PDF format, fill it out accurately, and file your income tax return online. Remember to keep records of all your financial transactions and seek professional guidance if you have complex financial situations. By staying compliant with tax regulations, you can enjoy peace of mind and avoid legal hassles in the future.