Income Tax Form 15CA Download PDF, Income Tax Form 15CA Download, Income tax form 15ca pdf, form 15ca online, form 15ca download in word format, How To file Form 15CA online, How to download 15 ca form, What is Form 15CA, Form 15CA Download, Form 15ca online download, form 15ca download, How to fill form 15ca, Income Tax Form 15CA Download English, Form 15CA PDF

Income Tax Form 15CA Download PDF : Income tax compliance is an essential aspect of responsible citizenship and business operation. In the digital age, many tax-related processes have been streamlined and simplified for the benefit of taxpayers. One such crucial form for individuals and businesses engaged in international transactions is Income Tax Form 15CA. In this comprehensive guide, we will delve into the details of Income Tax Form 15CA, its significance, and the steps to conveniently download it in PDF format.

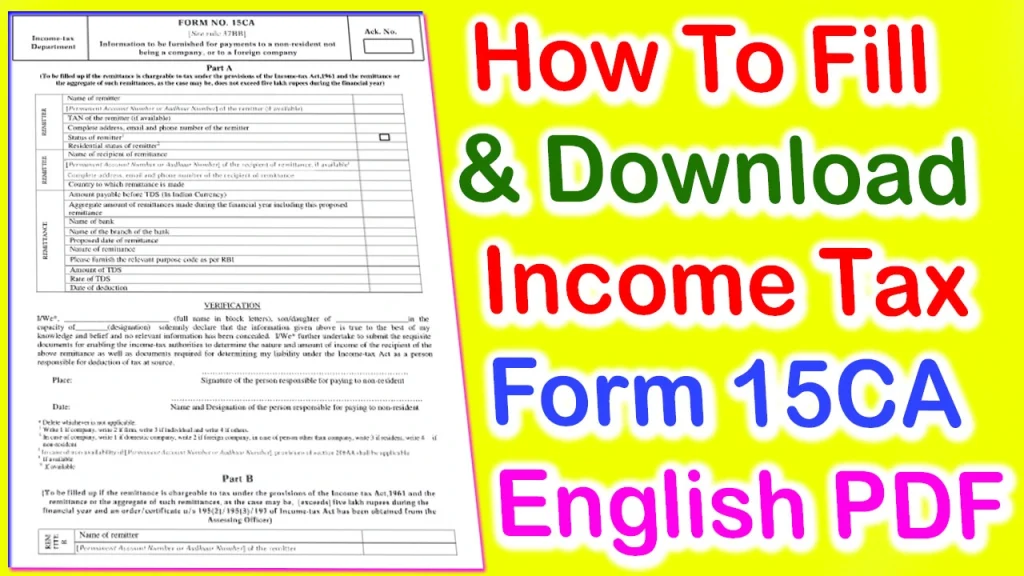

Income Tax Form 15CA Download PDF

Income Tax Form 15CA, often referred to as Form 15CA, is a critical document mandated by the Indian Income Tax Department. This form is primarily used for facilitating the collection of tax on payments made to non-residents, including foreign individuals, entities, or organizations. By filing this form, the tax authorities can keep a check on payments that may be subject to taxation under the Income Tax Act, 1961.

Significance of Income Tax Form 15CA

Income Tax Form 15CA Download PDF : Before we explore how to download Income Tax Form 15CA in PDF format, let’s understand why this form is significant.

- Regulatory Compliance: Form 15CA is a regulatory requirement enforced by the Income Tax Department to ensure that tax is deducted and deposited on payments made to non-residents. Failure to comply with this requirement can result in penalties and legal consequences.

- Tax Deduction at Source (TDS): This form helps in determining whether a payment to a non-resident is subject to Tax Deduction at Source (TDS). If it is, the payer must deduct the appropriate TDS and remit it to the government.

- Exchange Control Regulations: Form 15CA is also essential for compliance with the provisions of the Foreign Exchange Management Act (FEMA). It helps in monitoring and regulating foreign exchange transactions.

- Preventing Tax Evasion: By collecting information about international transactions, the government can prevent tax evasion and ensure that taxes due on such payments are collected in a timely manner.

Types of Payments Covered by Income Tax Form 15CA

Income Tax Form 15CA Download PDF : Income Tax Form 15CA is applicable to various types of payments made to non-residents. These payments include, but are not limited to:

- Salary or wages to foreign employees or consultants

- Interest on foreign loans or deposits

- Royalties or fees for technical services

- Purchase of property from a non-resident

- Any other payment to non-residents that is taxable in India

It is crucial to determine whether a specific payment falls under the purview of Form 15CA to ensure compliance with tax regulations.

Who is Required to Submit Income Tax Form 15CA?

The responsibility for filing Income Tax Form 15CA lies primarily with the person or entity making the payment to the non-resident. This person or entity, known as the ‘payer,’ must ensure that the form is submitted when applicable. Additionally, there are certain exemptions and conditions that determine whether Form 15CA is required.

How To Download Income Tax Form 9 PDF Online

Income Tax Form 16A Download PDF

How to Download Income Tax Form 15CA PDF

Income Tax Form 15CA Download PDF : Now, let’s delve into the practical aspect of this guide: how to download Income Tax Form 15CA in PDF format.

Step 1: Visit the Official Income Tax Department Website

The first step in downloading Form 15CA is to visit the official website of the Income Tax Department. The URL for the website is https://www.incometaxindia.gov.in.

Step 2: Navigate to the Forms Download Page

On the Income Tax Department’s website, look for the ‘Forms’ section. This is usually located in the top menu or in the sidebar. Click on ‘Forms.’

Step 3: Select the Appropriate Form

In the Forms section, you’ll find a list of various forms related to income tax and other financial matters. Scroll down until you find ‘Form 15CA.’ Click on it to proceed.

Step 4: Choose the Assessment Year

The next step is to select the assessment year for which you need Form 15CA. Assessment year refers to the year in which the income earned is assessed for tax purposes. Select the relevant assessment year from the drop-down menu.

How to Download Income Tax Form 15CA PDF

Income Tax Form 15CA Download PDF : Now, let’s delve into the practical aspect of this guide: how to download Income Tax Form 15CA in PDF format.

Step 1: Visit the Official Income Tax Department Website

The first step in downloading Form 15CA is to visit the official website of the Income Tax Department. The URL for the website is https://www.incometaxindia.gov.in.

Step 2: Navigate to the Forms Download Page

On the Income Tax Department’s website, look for the ‘Forms’ section. This is usually located in the top menu or in the sidebar. Click on ‘Forms.’

Step 3: Select the Appropriate Form

In the Forms section, you’ll find a list of various forms related to income tax and other financial matters. Scroll down until you find ‘Form 15CA.’ Click on it to proceed.

Step 4: Choose the Assessment Year

The next step is to select the assessment year for which you need Form 15CA. Assessment year refers to the year in which the income earned is assessed for tax purposes. Select the relevant assessment year from the drop-down menu.

Step 5: Download Form 15CA in PDF Format

After selecting the assessment year, you’ll see a link to download Form 15CA in PDF format. Click on this link to initiate the download. The PDF file will be saved to your computer or mobile device.

Income Tax Form 10E PDF Download In Hindi

Pan Card Form PDF Download

Filling Out Income Tax Form 15CA

Income Tax Form 15CA Download PDF : Once you have downloaded Form 15CA in PDF format, the next step is to fill it out accurately. The form consists of several sections, and the information to be provided includes:

- Details of Remitter: This section requires information about the person or entity making the payment to the non-resident, including their name, address, and PAN (Permanent Account Number).

- Details of Remittee: Here, you need to provide details about the non-resident recipient, including their name, address, and country of residence.

- Details of the Transaction: This section asks for details about the nature of the transaction, the amount involved, and the method of payment.

- Bank Details: You must provide the bank details of both the remitter and remittee, including the name of the bank, branch, and account number.

- Tax Liability and Tax Deducted at Source (TDS): This section requires you to specify whether the payment is taxable in India and whether TDS has been deducted.

- Documents Submitted: If any documents are being submitted along with Form 15CA, you should provide details of those documents in this section.

Digital Signature or Submission | Income Tax Form 15CA PDF

Depending on the amount and nature of the transaction, Form 15CA may require a digital signature for submission. The requirement for a digital signature is typically for high-value transactions. Ensure that you adhere to the guidelines provided by the Income Tax Department regarding digital signatures.

If a digital signature is not required, you can submit the form online. The online submission process usually involves uploading the filled-out Form 15CA in PDF format to the Income Tax Department’s website.

Acknowledgment | Income Tax Form 15CA PDF

After successfully submitting Form 15CA, you will receive an acknowledgment from the Income Tax Department. This acknowledgment serves as proof of submission and should be retained for your records.

पेन कार्ड डाउनलोड कैसे करें

आधार कार्ड अपडेट फॉर्म डाउनलोड कैसे करें

Penalties for Non-Compliance | Income Tax Form 15CA PDF

It’s important to note that failing to comply with the requirements of Form 15CA can result in penalties and legal consequences. The Income Tax Department takes tax evasion and non-compliance seriously. Penalties may include fines and legal action.

Conclusion – Income Tax Form 15CA Download PDF 2023

Income Tax Form 15CA Download PDF 2023 : Income Tax Form 15CA is a vital tool for ensuring tax compliance when making payments to non-residents. By following the steps outlined in this guide, you can easily download Form 15CA in PDF format from the official Income Tax Department website.

Remember to fill out the form accurately and submit it in a timely manner to avoid penalties and ensure that your international transactions are in compliance with Indian tax regulations. In summary, Income Tax Form 15CA download PDF is a crucial process for anyone involved in international transactions. It helps in maintaining transparency and accountability in cross-border payments, ultimately contributing