How to fill form 29c income tax, How to Download form 29c income tax, form 29c income tax, Income Tax form 29c Download, Income Tax form 29c PDF, Income Tax form 29c Download PDF, How to Fill Form 29C, How to fill form 29c income tax pdf, form 29b income tax, how to file form 29c online, How to fill form 29c income tax online, form 29c Download, form 29c PDF, form 29c Online, form 29c

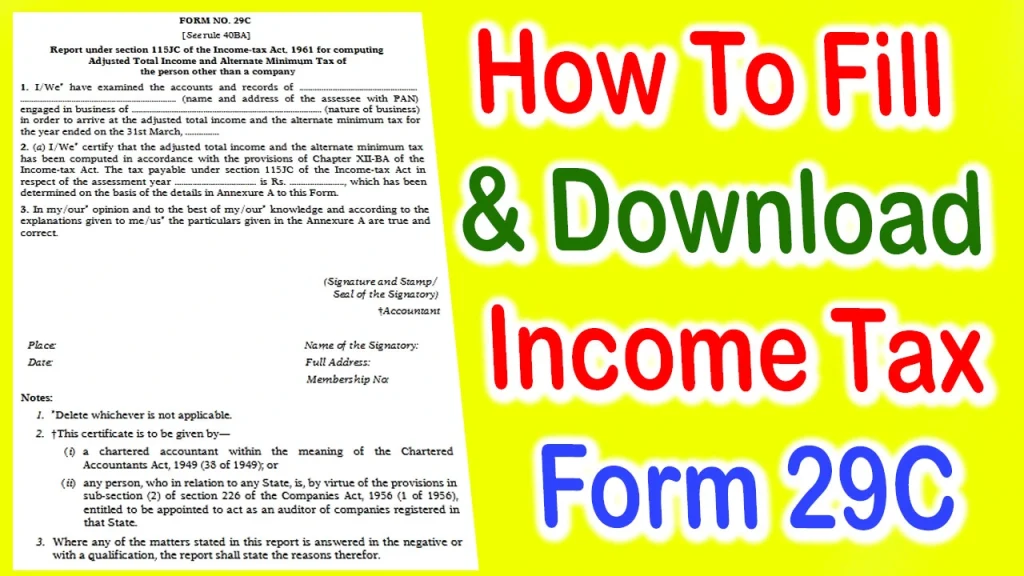

Income tax compliance is a crucial aspect of financial responsibility for every individual and business entity. One of the essential documents in this process is Income Tax Form 29C, which is used to report certain financial transactions. In this comprehensive guide, we will walk you through the steps of filling and downloading Income Tax Form 29C online.

Whether you’re an individual taxpayer or a business owner, understanding the process is essential to ensure that you meet your tax obligations accurately and efficiently. So, let’s get started with the process of Income Tax Form 29C download PDF and how to fill it correctly.

Form 29C Income Tax Download PDF

Income Tax Form 29C is a document used by taxpayers to report specific transactions that may have an impact on their income tax liability. These transactions are related to the sale, purchase, or transfer of immovable property. The primary purpose of Form 29C is to provide the Income Tax Department with information about these transactions, allowing them to assess the taxpayer’s income tax liability accurately.

Key information about Income Tax Form 29C:

- It is a statutory requirement under Section 269UC of the Income Tax Act, 1961.

- The form must be filed within prescribed time limits to avoid penalties.

- Form 29C is essential for both buyers and sellers of immovable property.

- It helps the Income Tax Department track high-value property transactions.

Prerequisites for Filling Form 29C

Before you begin the process of filling and downloading Income Tax Form 29C, you need to gather certain essential information and documents. Here’s a checklist of what you’ll need:

- Permanent Account Number (PAN): Ensure you have a valid PAN, as it is mandatory for filing Form 29C.

- Details of the Property Transaction: You should have complete details of the property transaction, including the property’s address, sale/purchase price, date of agreement, and other relevant information.

- Details of the Parties Involved: Collect information about the buyer and seller, including their PANs and Aadhar numbers.

- Challan Details: If you’ve paid the consideration amount through a bank, you’ll need the details of the challan, such as BSR code, date of payment, and challan number.

- Digital Signature Certificate (DSC): If you are filing the form on behalf of a company or other business entity, you may need a DSC.

- Income Tax Return (ITR) Forms: Depending on your income, you might need to file an ITR along with Form 29C.

How To Download Form 29C Income Tax Online

How To Fill Form 29C Income Tax Online

Now that you’ve gathered all the necessary information and documents, it’s time to start filling out Income Tax Form 29C online. Follow these step-by-step instructions:

Step 1: Visit the Income Tax Department’s official website

To begin the process, visit the official website of the Income Tax Department (www.incometaxindiaefiling.gov.in).

Step 2: Login or Register

If you have an account, log in using your PAN as the user ID and password. If you don’t have an account, you’ll need to register.

Step 3: Navigate to the e-File section

Once you’re logged in, navigate to the ‘e-File’ section on the website.

Step 4: Select the ‘Income Tax Forms’ option

Under the ‘e-File’ section, select the ‘Income Tax Forms’ option.

Step 5: Choose Form 29C

From the list of available forms, select ‘Form 29C – Report Under Section 269UC(2).’

Step 6: Fill in the details

Now, you’ll need to fill in all the required details accurately. This includes information about the property transaction, parties involved, and challan details (if applicable).

Step 7: Verify the information

Double-check all the information you’ve entered to ensure its accuracy. Any errors or discrepancies may lead to delays or complications in the process.

Step 8: Submit the form

After verifying the information, submit the Form 29C electronically. You may also be required to attach supporting documents if necessary.

Step 9: Generate acknowledgment

Once the form is successfully submitted, the system will generate an acknowledgment with a unique acknowledgment number. This acknowledgment serves as proof of your submission.

Income Tax Form 15CA Download PDF

How To Download Income Tax Form 9 PDF Online

How To Download Income Tax Form 29C PDF

After successfully filing Form 29C, you should also download a PDF copy for your records. Here’s how you can do it:

Step 1: Log in to your account

Return to the e-Filing portal and log in using your credentials.

Step 2: Go to ‘My Account’

Navigate to the ‘My Account’ tab.

Step 3: Click on ‘View Form 29C’

Under the ‘View Form 29C’ option, you can access the form you previously filed.

Step 4: Download the PDF

Click on the ‘Download PDF’ option to obtain a copy of your filed Form 29C in PDF format.

Important Points to Remember

- Timely Filing: Ensure that you file Form 29C within the prescribed time limits to avoid penalties and legal consequences.

- Accuracy: Double-check all the information before submission to avoid errors and complications.

- Supporting Documents: Keep all relevant documents and receipts as proof of your transaction.

- Digital Signature: If required, obtain a valid Digital Signature Certificate for your entity.

- Consult a Tax Professional: If you’re unsure about any aspect of the form or the transaction, consider seeking advice from a tax professional.

FAQ’s- Form 29C Income Tax PDF Download In Hindi

Q: What is the purpose of downloading Income Tax Form 29C in PDF format?

Ans: Downloading Income Tax Form 29C in PDF format allows individuals and businesses to maintain a digital record of their filed form for their records and reference.

Q: Where can I find the option to download Income Tax Form 29C in PDF after filing it online?

Ans: To download the PDF copy of your filed Income Tax Form 29C, log in to your account on the Income Tax Department’s e-Filing portal, go to the ‘My Account’ tab, and click on ‘View Form 29C.’ From there, you can access the ‘Download PDF’ option.

Q: Why is it important to keep a PDF copy of Form 29C after filing it online?

Ans: Keeping a PDF copy of Form 29C is crucial for record-keeping and documentation purposes. It serves as proof that you have filed the form and can be helpful for future reference or in case of any disputes.

Q: Is there a specific format or naming convention for the downloaded Income Tax Form 29C PDF?

Ans: There is typically no specific format or naming convention for the downloaded PDF. However, it is advisable to save it with a clear and descriptive name for easy identification and retrieval.

Q: Can the downloaded Income Tax Form 29C PDF be used as an official document for legal or tax purposes?

Ans: Yes, the downloaded Income Tax Form 29C PDF is considered an official document and can be used as proof of filing for legal or tax purposes.

Income Tax Form 16A Download PDF

Income Tax Form 10E PDF Download In Hindi

Q: How often should individuals and businesses download and archive their Income Tax Form 29C PDFs?

Ans: It is a good practice to download and archive your Income Tax Form 29C PDFs immediately after filing and keep them for the relevant assessment years. This ensures that you have a record of your financial transactions for tax purposes.

Q: Can the downloaded PDF copy of Income Tax Form 29C be edited or modified?

Ans: No, the downloaded PDF copy of Income Tax Form 29C should not be edited or modified, as it is an official document. Any changes or corrections should be made by filing an amendment, if necessary.

Q: What information should individuals verify before downloading the Income Tax Form 29C PDF?

Ans: Before downloading the Income Tax Form 29C PDF, individuals should verify that all the information entered in the form is accurate and matches the details of the property transaction and the parties involved.

Q: Is it mandatory to download the Income Tax Form 29C PDF after filing it online?

Ans: While it is not mandatory, it is highly recommended to download the Income Tax Form 29C PDF as it serves as a record of your filed form and can be valuable for future reference.

Q: How can individuals ensure the security of their downloaded Income Tax Form 29C PDF?

Ans: To ensure the security of the downloaded Income Tax Form 29C PDF, individuals should store it in a secure and password-protected location. Additionally, they should avoid sharing it with unauthorized individuals and regularly update their login credentials on the Income Tax Department’s e-Filing portal.

Conclusion – How To Download Income Tax Form 29C PDF

Filing and downloading Income Tax Form 29C online is an essential step in ensuring your compliance with income tax regulations, particularly when dealing with high-value property transactions. By following the steps outlined in this comprehensive guide, you can accurately complete the process and avoid any legal complications.

Remember to stay updated with the latest tax regulations and deadlines to maintain your financial responsibility. Income Tax Form 29C Download PDF is a critical part of this process, and by following these steps, you can ensure that you fulfill your tax obligations effectively.