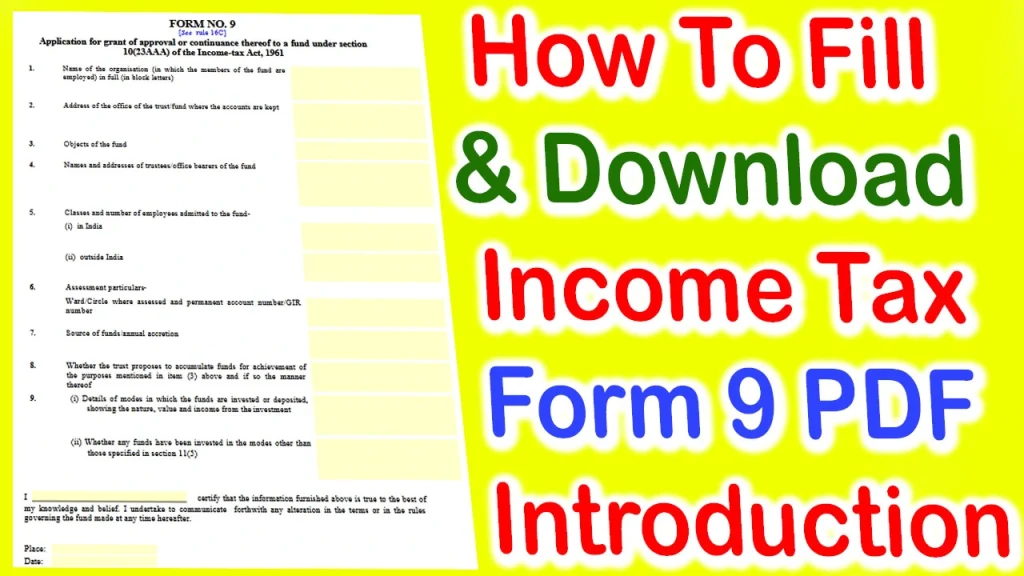

How To Download Income Tax Form 9 PDF, Income Tax Form 9 PDF, Income Tax Form 9 PDF Online, How To Fill Form 9, Income tax form 9 download pdf india, income tax form pdf download, form 9 Download, Income Tax Department Form 9 PDF, Income Tax Form 9 PDF In Hindi, Income Tax Form 9 PDF In English, Income Tax Form 9 PDF Download, form 9 property tax download, form 9 pdf

Income tax compliance is a crucial aspect of financial responsibility for individuals and businesses in India. To facilitate this process, the Indian government has developed a range of tax forms tailored to various income sources and types of taxpayers. One such form is Income Tax Form 9, which plays a pivotal role in reporting income and ensuring adherence to tax regulations. In this comprehensive guide, we will explore Income Tax Form 9, its importance, and the step-by-step process of Income Tax Form 9 download PDF in India.

What is Income Tax Form 9?

Income Tax Form 9, commonly known as ITR-9, is a tax return form used by individuals and Hindu Undivided Families (HUFs) to report their income and deductions for a specific financial year. It is applicable to taxpayers who are not eligible to file their returns using simpler forms like ITR-1 or ITR-4. ITR-9 is primarily designed for individuals with income from business or profession.

Importance of Income Tax Form 9

Income Tax Form 9 holds significant importance for the following reasons:

a. Comprehensive Reporting: ITR-9 allows taxpayers to provide detailed information about their income, expenses, and deductions, ensuring accurate reporting of financial transactions.

b. Legal Compliance: Filing ITR-9 is mandatory for individuals and HUFs with business or professional income. Compliance with tax regulations is essential to avoid penalties and legal complications.

c. Assessment and Refunds: The information provided in ITR-9 is used by the Income Tax Department to assess the taxpayer’s liability or eligibility for refunds.

d. Audit Trail: ITR-9 serves as an audit trail, enabling tax authorities to cross-verify income and expenses declared by the taxpayer.

How To Download Income Tax Form 9 PDF Online

Eligibility for Income Tax Form 9

Who Should File ITR-9?

To determine whether you need to file Income Tax Form 9, consider the following criteria:

- Individuals and HUFs: ITR-9 is applicable to individuals and Hindu Undivided Families who have income from business or profession during the financial year.

- Income Sources: If your income includes earnings from a partnership firm, proprietorship, or professional practice, you should file ITR-9.

- Exceeding Thresholds: If your total income before claiming deductions exceeds the basic exemption limit, you are required to file ITR-9.

Who Should Not File ITR-9?

You do not need to file ITR-9 if:

- You have income only from salary, house property, or other sources, and your total income is below the exemption limit.

- You are eligible to file a simpler tax return form like ITR-1 or ITR-4.

Income Tax Form 16A Download PDF

Income Tax Form 10E PDF Download In Hindi

Income Tax Form 9 Download PDF in India

Steps to Download Income Tax Form 9 PDF – Downloading Income Tax Form 9 in PDF format is a straightforward process. Follow these steps:

Step 1: Visit the Income Tax Department’s official website (https://www.incometaxindiaefiling.gov.in/).

Step 2: Log in to your e-filing account using your User ID, Password, and Captcha.

Step 3: Once logged in, click on the “e-File” tab and select “Income Tax Forms” from the dropdown menu.

Step 4: Choose the assessment year for which you want to file the return.

Step 5: In the Form Name column, select “ITR-9.”

Step 6: Choose the submission mode as “Prepare and Submit Online” or “Download PDF.”

Step 7: If you opt to download the PDF, click on the “Excel Utility” link to download the ITR-9 form in Excel format.

Step 8: Open the downloaded Excel file, fill in the required details, and validate the form.

Step 9: Generate the XML file and save it on your computer.

Step 10: Upload the XML file to your e-filing account on the Income Tax Department’s website.

Common Issues While Downloading ITR-9

While downloading Income Tax Form 9 PDF in India, taxpayers may encounter some common issues, including:

- Technical Glitches: Slow internet connections or server issues on the Income Tax Department’s website may lead to download problems. Ensure a stable internet connection.

- Incorrect Login Credentials: Double-check your User ID and Password to ensure they are entered correctly. Consider using the “Forgot Password” option if necessary.

- Browser Compatibility: Some browsers may not work optimally with the Income Tax Department’s website. Try using a different browser if you face issues.

- Pop-Up Blockers: Disable any pop-up blockers in your browser settings to ensure that PDFs can be downloaded without interruption.

Filing Income Tax Form 9

Preparing and Filing ITR-9

Once you have successfully downloaded Income Tax Form 9 in PDF format, the next step is to fill it out accurately and file your tax return. Here’s a simplified guide to help you through the process:

- Gather Financial Information: Collect all necessary financial documents, including income statements, balance sheets, profit and loss statements, and relevant receipts.

- Fill Out the Form: Open the downloaded PDF form and fill in the required information diligently. Ensure accuracy to avoid discrepancies.

- Verify and Validate: Double-check all entries for accuracy. Use the built-in validation tool in the PDF form to identify any errors or omissions.

- Generate XML File: After validation, generate the XML file from the PDF form. Save this file on your computer.

- Upload XML File: Log in to your e-filing account on the Income Tax Department’s website and upload the XML file.

- Verify and Submit: Review the information once more and confirm that all details are accurate. Then, submit the form.

Pan Card Form PDF Download कैसे करें हिंदी में

पेन कार्ड में नाम कैसे चेंज करें 2023

Income Tax Form 9 Acknowledgment

After successfully filing your Income Tax Form 9, you will receive an acknowledgment in the form of an ITR-V (Income Tax Return-Verification) through email. You must download, print, sign, and send the signed ITR-V to the Centralized Processing Center (CPC) within 120 days from the date of e-filing.

Tips for Smooth ITR-9 Filing

Maintain Accurate Records

To ensure a smooth ITR-9 filing process, maintain accurate and detailed records of your financial transactions throughout the financial year. This will make it easier to fill out the form and reduce the chances of errors.

Seek Professional Assistance

If you find Income Tax Form 9 too complex to handle on your own, consider seeking assistance from a qualified tax professional or chartered accountant. They can provide expert guidance and ensure compliance with tax laws.

Use Offline Utility

The Income Tax Department provides an offline utility to fill out ITR-9 offline. This can be especially useful if you face connectivity issues while filling out the form online.

Keep Abreast of Updates

Tax laws and regulations may change from year to year. Stay informed about the latest updates and amendments to the tax code to ensure accurate filing.

पेन कार्ड डाउनलोड कैसे करें

आधार कार्ड अपडेट फॉर्म डाउनलोड कैसे करें

Conclusion – How To Download Income Tax Form 9 PDF Online

Income Tax Form 9, or ITR-9, is a crucial document for individuals and HUFs with business or professional income in India. Filing this form accurately and in a timely manner is essential to comply with tax regulations and avoid legal repercussions. With the step-by-step guide provided in this article, you can easily download Income Tax Form 9 PDF in India and complete the filing process. Remember to maintain accurate records, seek professional guidance when necessary, and stay informed about tax law changes to ensure a hassle-free tax filing experience.