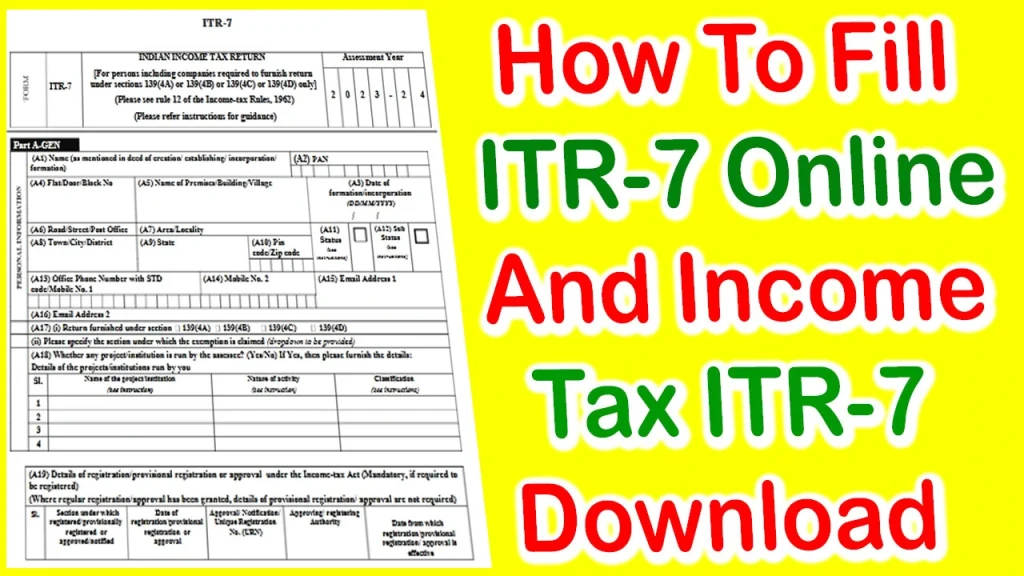

ITR 7 Income Tax Form PDF Download, Itr 7 income tax pdf, ITR 7 Income Tax Form PDF, Itr 7 income tax online, Itr 7 income tax format, Itr 7 income tax form pdf, Itr 7 income tax form, Itr 7 income tax download, Itr 7 income tax calculator, itr-7 pdf, Income Tax ITR 7 PDF, Income Tax ITR 7 Download, Income Tax ITR 7 PDF Download, Income Tax ITR 7 PDF In Hindi, Income Tax ITR 7 PDF

ITR 7 Income Tax Form PDF Download : Filing income tax returns is a crucial financial responsibility for individuals and entities alike. For charitable trusts and associations, Form ITR-7 is the designated form for reporting their income and claiming tax exemptions. In this article, we will provide you with a comprehensive guide to Form ITR-7, outlining its purpose, eligibility criteria, and the steps involved in filing.

Understanding Form ITR-7

Form ITR-7 is a specialized income tax return form introduced by the Indian government for entities that are required to furnish their income details under Section 139(4A), Section 139(4B), or Section 139(4C) of the Income Tax Act, 1961. These sections pertain to the following entities:

- Trusts: Trusts created under Indian law, including public charitable trusts, private trusts, and other types of trusts.

- Political Parties: This section covers registered political parties.

- Research Associations: Associations engaged in scientific research, educational research, or social science research.

Eligibility Criteria

Not all trusts and associations are required to file Form ITR-7. It is mandatory for those that fall under the aforementioned sections. Here’s a breakdown of the eligibility criteria:

Trusts

- Public Charitable Trusts: Trusts that are registered as public charitable trusts and have an income exceeding the tax exemption limit must file Form ITR-7.

- Private Trusts: Private trusts that have income that is chargeable to tax under the Income Tax Act, 1961, are also required to file this form.

Political Parties

Political parties that are registered under Section 29A of the Representation of the People Act, 1951, and have an income exceeding the exemption limit must file Form ITR-7.

Research Associations

Associations involved in scientific, educational, or social science research, which are eligible for tax exemptions under Section 10(21) or Section 10(23A), must file Form ITR-7 if their income exceeds the exemption limit.

Income Tax Form 29b PDF Download

Income Tax Form 3ceb Download PDF

How To Fill ITR 7 Income Tax Form

Filing Form ITR-7 involves several steps, including gathering the necessary documents and information, filling out the form accurately, and submitting it to the relevant authorities. Here’s a simplified guide:

Gather Documents and Information

Before you start filling out Form ITR-7, ensure you have the following documents and information ready:

- PAN Card: Permanent Account Number (PAN) card of the trust or association.

- Income Details: Accurate income details for the financial year, including donations received, investments, and other sources of income.

- Bank Statements: Bank statements for all relevant accounts.

- Registration Documents: Copies of trust deed, registration certificates, and other legal documents.

- Tax Deducted at Source (TDS) Certificates: TDS certificates received for tax deducted, if applicable.

- Audit Reports: Audited financial statements and reports, if applicable.

Fill Out Form ITR-7

The form consists of several sections, including general information, income details, and tax computation. Carefully fill out each section, ensuring accuracy and completeness. You may need to attach additional schedules and annexures depending on your income sources.

Verification

After completing the form, it’s essential to verify it. The person authorized to sign the return, such as the trustee or authorized representative, should sign and date the form.

Submission

You can submit Form ITR-7 electronically through the income tax department’s official website. Ensure that you select the correct assessment year and file within the due date.

Acknowledgment

Upon successful submission, you will receive an acknowledgment receipt. Keep this receipt for your records.

Important Dates

It’s crucial to be aware of the due dates for filing Form ITR-7. The due date typically falls on or before July 31st of the assessment year. However, it’s advisable to check the latest notifications and updates from the income tax department for any changes in due dates.

Form 15CB Income Tax PDF Download

How To Fill And Download Form 29C Income Tax Online

How To Download ITR 7 Income Tax Form PDF

ITR 7 Income Tax Form PDF – ITR 7 Download PDF

Who can file ITR-7?

ITR-7 Form can be used by persons including companies who are required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D). The category of persons whose income is unconditionally exempt under various clauses of section 10, and who are not mandatorily required to furnish their return of income under the provisions of section 139, may use relevant ITR form for filing return. From A.Y.2022-23 onwards ITR 7 will not be applicable to the persons whose income is unconditionally exempt.

What is the manner of filing of ITR-7?

ITR-7 can be filed with the Income‐tax Department electronically on the e‐ filing web portal of Income‐tax Department (www.incometax.gov.in) and verified in any one of the following manner–

- Digitally signing the verification part, or

- Authenticating by way of electronic verification code (EVC),or

- Aadhaar OTP

- By sending duly signed paper Form ITR‐V – Income Tax Return Verification Form by post to CPC at the following address–

Centralized Processing Centre, Income Tax Department, Bengaluru— 560500, Karnataka”. The Form ITR‐V‐Income Tax Return Verification Form should reach within 120/30 days from the date of e‐ filing the return. The confirmation of the receipt of ITR‐V at Centralized Processing Centre will be sent to the assessee on e‐ mail ID registered in the e‐Filing account.

However, a political party shall compulsorily furnish the return in the manner mentioned at (i) above. In case an assessee is required to furnish a report of audit under sections 10(23C)(iv),10(23C)(v),10(23C)(vi),10(23C)(via),12A(1)(b),92E it shall be required to file such report electronically on or before the due date.

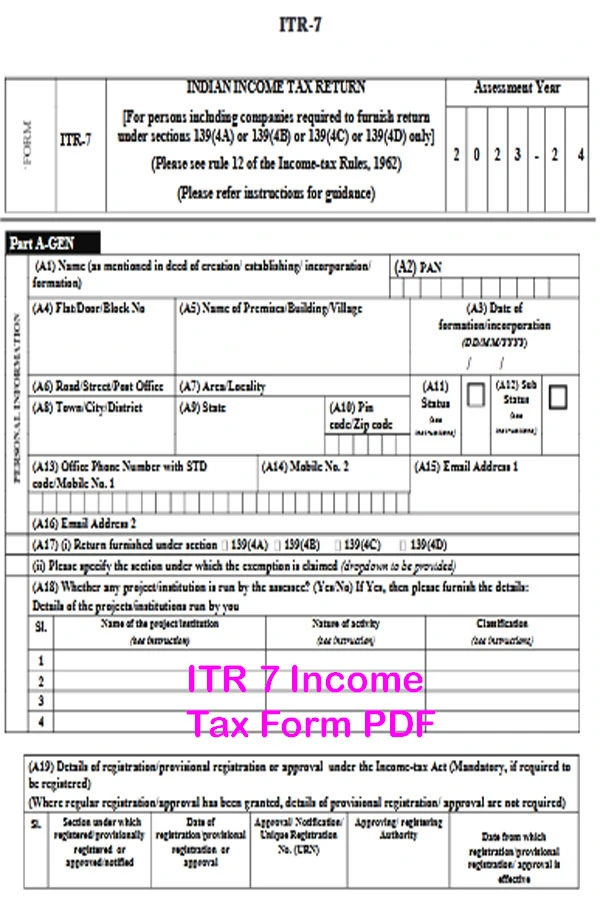

Which information is required to be filled in PART A General of ITR-7 ?

In part A General, furnish the information relating to identity of assessee, details of any project or institution run by the assessee during the year, section under which return is filled and section under which exemption has been claimed, details of registration/ provisional registration or approval under the Income Tax Act etc.

Income Tax Form 15CA Download PDF

How To Download Income Tax Form 9 PDF Online

What is the structure of the ITR-7 Form?

- ITR-7 form has been divided into Part A, Part B and Schedules.

- Part-A – General information

- Part-B – Statement of the total income and tax computation with respect to income chargeable to tax.

- Schedule-I: Details of amounts accumulated/ set apart within the meaning of section 11(2) or in terms of third proviso to section 10(23C)/10(21) read with section 35(1) in last 7 financial years viz., previous years relevant to the current AY.

- Schedule-D: Details of deemed application of income under clause (2) of Explanation 1 to sub-section (1) of section 11.

- Schedule-J: Statement showing the investment of all funds of the Trust or Institution as on the last day of the previous year.

- Part A-BS : Details of Application and Sources of Fund as on 31st March 2022

- Schedule-LA: Details in case of a political party.

- Schedule-ET: Details in case of an Electoral Trust

- Schedule-VC: Details of Voluntary Contributions received.

- Schedule AI: Aggregate of income derived during the year excluding voluntary contributions

- Schedule ER: Amount applied to charitable or religious purposes in India – Revenue Account

- Schedule EC: Amount applied to charitable or religious purposes in India – Capital Account

- Schedule IE-1, IE-2, IE-3 and IE-4: Income and expenditure statements as applicable

- Schedule-HP: Computation of income under the head Income from House Property.

- Schedule-CG: Computation of income under the head Capital gains.

- Schedule-OS: Computation of income under the head Income from other sources.

- Schedule-OA: General information about business and profession

- Schedule-BP: Computation of income under the head “profit and gains from business or profession

- Schedule-CYLA: Statement of income after set off of current year’s losses

- Schedule PTI: Pass through Income details from business trust or investment fund as per section 115UA, 115UB

- Schedule-SI: Statement of income which is chargeable to tax at special rates

- Schedule 115TD: Accreted income under section 115TD

- Schedule FSI: Details of income accruing or arising outside India

- Schedule TR: Details of tax relief claimed for taxes paid outside India

- Schedule FA: Details of Foreign Assets and Income from any source outside India

- Schedule-SH: Details of shareholding in an unlisted company

- Part B-TI: Computation of total income

- Part B-TTI: Computation of tax liability on total income

- Tax payments:

- Details of payments of Advance Tax and Self-Assessment Tax

- Details of Tax Deducted at Source (TDS) on Income (As per Form 16A/16B/16C/16D).

- Details of Tax Collected at Source (TCS)

Under which section ITR-7 return can be filed ?

Section under which the ITR-7 return can be filed –

(a) If filed voluntarily on or before the due date, 139(1)

(b) If filed voluntarily after the due date, 139(4)

(c) If it is a revised return, 139(5)

(d) if it is a modified return, 92(CD)

(e) If filed in pursuance to an order u/s 119(2)(b) condoning the delay, 119(2)(b)

Do I need to mention the Residential Status in ITR-7?

Yes, Please specify the residential status in India whether it is Resident or Non-Resident.

Can a representative assessee file ITR-7 ?

Yes, In case the return is being filed by a representative assessee, furnish the following information:‐

(a) Name of the representative

(b) Capacity of the representative

(c) Address of the representative

(d) PAN/Aadhaar Number of the representative

Can ITR-7 be filed in response to notice/order?

Yes, In case the return is being filed in response to a statutory notice, or in pursuance to an order under section 119(2)(b) condoning the delay, enter the Unique number/Document Identification Number(DIN) and date of the relevant statutory notice, or the date of condonation order or if filed u/d 92CD enter the date of advance pricing agreement.

Income Tax Form 16A Download PDF

Income Tax Form 10E PDF Download In Hindi

Conclusion – ITR 7 Income Tax Form PDF Download

Filing Form ITR-7 is an essential compliance requirement for charitable trusts, political parties, and research associations. By understanding the eligibility criteria and following the correct filing process, these entities can fulfill their tax obligations and continue their valuable contributions to society. It is advisable to consult with a tax professional or chartered accountant to ensure accurate and timely filing of Form ITR-7 to prevent any legal issues or penalties.