Pan form 49a pdf download, How To Fill Out Pan Form 49A PDF Online, pan card form pdf, pan card form correction pdf, 49a correction form, Form 49A PDF Download, How To Download form 49a PDF, Pan Card 49A Form PDF Download, Form 49A Download, Form 49A PDF, Form 49A PDF In Hindi, Form 49A Fill Online, Form 49A Download PDF, form 49a online download, form no 49a online application, form 49a documents required

Form 49A PDF Download : The Permanent Account Number (PAN) is a unique alphanumeric identifier issued by the Indian government to individuals, companies, and entities. It plays a crucial role in financial transactions, tax compliance, and various other official purposes. To apply for a PAN card, one must complete Form 49A, which can be conveniently downloaded as a PDF from the official website of the Income Tax Department of India. In this article, we’ll guide you through the process of downloading Form 49A PDF and help you understand how to fill it out accurately.

How To Download Pan Card Form 49A PDF

To download Form 49A PDF, follow these simple steps:

- Visit the official website of the Income Tax Department of India. You can do this by typing “https://www.incometaxindia.gov.in” in your web browser’s address bar.

- Navigate to the “Forms/Downloads” section. Look for a link that says “PAN,” “PAN Application,” or “Form 49A.” This link will lead you to the page where you can download Form 49A.

- Click on the link to Form 49A. It will typically be available in PDF format. Your browser should automatically download the PDF file to your computer or device.

- Once the download is complete, locate the downloaded file, and you’re ready to begin the application process.

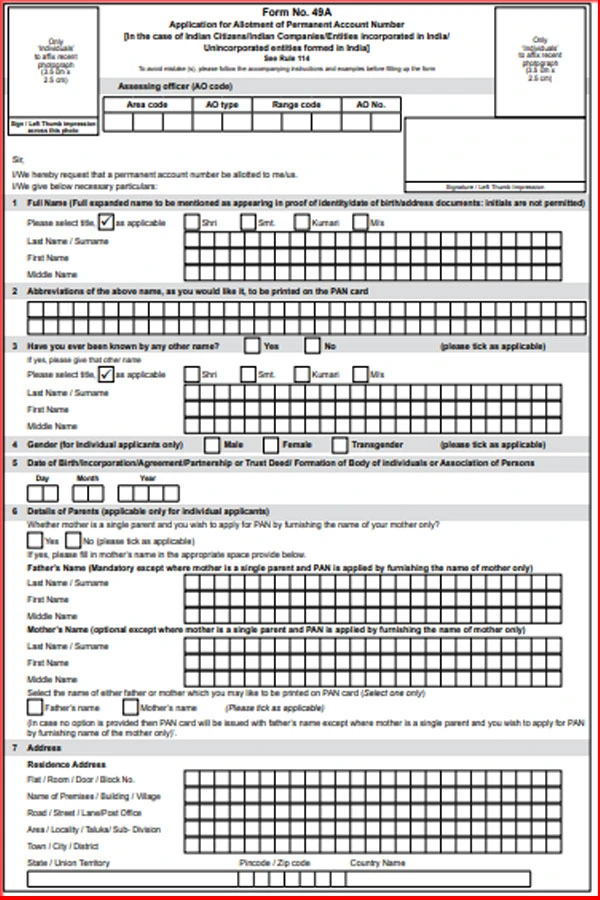

How To Fill Out Form 49A PDF Download

Filling out Form 49A can be a bit overwhelming, but we’ll break it down into manageable sections to make it easier.

- Applicant Details: This section requires you to provide basic information such as your name, address, and contact details. Make sure to enter all the details accurately and in the format specified in the form.

- Status of Applicant: Specify your status – whether you are an individual, company, or other entity.

- Registration Number (If applicable): If you have a registration number, enter it here. This is typically for companies or entities.

- Source of Income: State the source of your income, e.g., salary, business, or other sources.

- Representative Assessee: If you are applying as a representative assessee, provide the required details.

- Aadhaar Number (if available): If you have an Aadhaar number, provide it. It’s not mandatory, but it can simplify the application process.

- Address for Communication: This is where you should specify the address where you’d like to receive your PAN card.

- Telephone Number and Email ID (if available): Provide your contact information.

- Area Code, AO Type, Range Code, AO Number: These details are typically based on your location. You can find the details in the “Know Your AO Code” section on the official website.

- Details of Parents: Include your father’s and mother’s names.

- Documents Submitted: List the documents you are attaching as proof of identity and address.

- Declaration: Sign and date the form.

ITR 7 Income Tax Form PDF Download

Form 15CB Income Tax PDF Download

How To Download Form 49A PDF Online

Pan Form 49A PDF Download Link – Download PDF

Form 49A Documents Required

Along with your filled-out Form 49A, you will need to submit supporting documents such as proof of identity, address, and photographs as specified in the form’s instructions.

Form 49A PDF Download Submission

Once you have filled out the form and gathered the necessary documents, you can submit your PAN card application. You can either submit it online through the NSDL or UTITSL website or physically at a nearby PAN center.

Instructions For Filling Form 49A PDF

- Form to be filled legibly in BLOCK LETTERS and preferably in BLACK INK. Form should be filled in English only.

- Each box, wherever provided, should contain only one character (alphabet /number / punctuation sign) leaving a blank box after each word.

- ‘Individual’ applicants should affix two recent colour photographs with white background (size 3.5 cm x 2.5 cm) in the space provided on the form. The photographs should not be stapled or clipped to the form. The clarity of image on PAN card will depend on the quality and clarity of photograph affixed on the form.

- Signature / Left hand thumb impression should be provided across the photo affixed on the left side of the form in such a manner that portion of signature/impression is on photo as well as on form.

- Signature /Left hand thumb impression should be within the box provided on the right side of the form. The signature should not be on the photograph affixed on right side of the form. If there is any mark on this photograph such that it hinders the clear visibility of the face of the applicant, the application will not be accepted.

- Thumb impression, if used, should be attested by a Magistrate or a Notary Public or a Gazetted Officer under official seal and stamp.

- AO code (Area Code, AO Type, Range Code and AO Number) of the Jurisdictional Assessing Officer must be filled up by the applicant. These details can be obtained from the Income Tax Office or PAN Centre or websites of PAN Service Providers on www.utiitsl.com or www.protean-tinpan.com.

Income Tax Form 3ceb Download PDF

Income Tax Form 29b PDF Download

General Information For PAN Card Form 49A PDF

- Applicants may obtain the application form for PAN (Form 49A) from any IT PAN Service Centres (managed by UTIITSL) or TIN-Facilitation Centres (TIN-FCs) / PAN Centres (managed by Protean), or any other stationery vendor providing such forms or download from the Income Tax Department website (www.incometaxindia.gov.in) / UTIITSL website (www.utiitsl.com) / Protean website (www.protean-tinpan.com).

- The fee for processing PAN application is as under: If physical PAN Card is required, 107/-(including goods & service tax) will have to be paid by the applicant.In case, the PAN card is to be dispatched outside India then additional dispatch charge of 910/- will have to be paid by applicant. If physical PAN Card is not required ` 72/- (including goods & service tax) will have to be paid by the applicant. PAN applicants will have to mention on the top of the application form “Physical PAN Card not required”. In such cases, email ID will have to be mandatorily provided to receive e-PAN Card.

- Those already allotted a ten digit alphanumeric PAN shall not apply again as having or using more than one PAN is illegal. However, request for a new PAN card with the same PAN or/and Changes or Correction in PAN data can be made by filling up ‘Request for New PAN Card or/and Changes or Correction in PAN Data’ form available from any source mentioned in (a) above. The cost of application and processing fee is same as in the case of Form 49A.

- Applicant will receive an acknowledgment containing a unique number on acceptance of this form. This acknowledgment number can be used for tracking the status of the application.

How To Fill And Download Form 29C Income Tax Online

Income Tax Form 15CA Download PDF

Conclusion – Pan Form 49A Download PDF

Obtaining a PAN card is an essential step for financial and tax-related activities in India. Downloading Form 49A as a PDF from the official Income Tax Department website is a straightforward process. By following the steps outlined in this article and accurately filling out the form, you can ensure a smooth and hassle-free application for your PAN card. Remember to double-check all the information and documents you submit to avoid any delays in the process.