IRS W-4V Form 2023 PDF, How To Fill IRS W-4V Form PDF, how do i send w-4v to social security, Form W-4V, Voluntary Withholding Request, w-4v form 2023, can i fill out form w-4v online, IRS W-4V Form 2023 PDF, IRS W-4V Form Download, How To Download IRS W-4V Form PDF, W-4V Form Download PDF, W-4V Form PDF, Form W-4V Download, printable w-4v form 2023

IRS W-4V Form 2023 PDF Download : The IRS W-4V Form 2023 PDF is a crucial document that plays a significant role in your tax-related affairs. This form, officially known as the “Voluntary Withholding Request,” is used to specify the amount of federal income tax that should be withheld from certain types of payments, such as unemployment compensation or Social Security benefits.

In this comprehensive guide, we will delve deep into the IRS W-4V Form 2023 PDF, discussing its purpose, instructions for filling it out, the implications of your choices, and more. By the end of this article, you will have a thorough understanding of this form and its significance in your financial life.

Purpose of IRS W-4V Form 2023 PDF Download

If you receive any government payment shown below, you may use Form W-4V to ask the payer to withhold federal income tax.

- Unemployment compensation (including Railroad Unemployment Insurance Act (RUIA) payments).

- Social security benefits.

- Social security equivalent Tier 1 railroad retirement benefits.

- Commodity Credit Corporation loans.

- Certain crop disaster payments under the Agricultural Act of 1949 or under Title II of the Disaster Assistance Act of 1988.

- Dividends and other distributions from Alaska Native Corporations to its shareholders.

Consult your payer if you’re uncertain whether your payment is eligible for voluntary withholding. You aren’t required to have federal income tax withheld from these payments. Your request is voluntary.

Note. Payers may develop their own form for you to request federal income tax withholding. If a payer gives you its own form instead of Form W-4V, use that form.

Why Should I Request Withholding?

You may find that having federal income tax withheld from the listed payments is more convenient than making quarterly estimated tax payments. However, if you have other income that isn’t subject to withholding, consider making estimated tax payments. For more details, see Form 1040-ES, Estimated Tax for Individuals.

How To Fill Form SSA 3820 BK PDF Download

How To Fill Out SSA 827 Form PDF

How Much Can I Have Withheld? – IRS W-4V Form 2023 PDF

For unemployment compensation, the payer is permitted to withhold 10% from each payment. No other percentage or amount is allowed. For any other government payment listed above, you may choose to have the payer withhold federal income tax of 7%, 10%, 12%, or 22% from each payment, but no other percentage or amount.

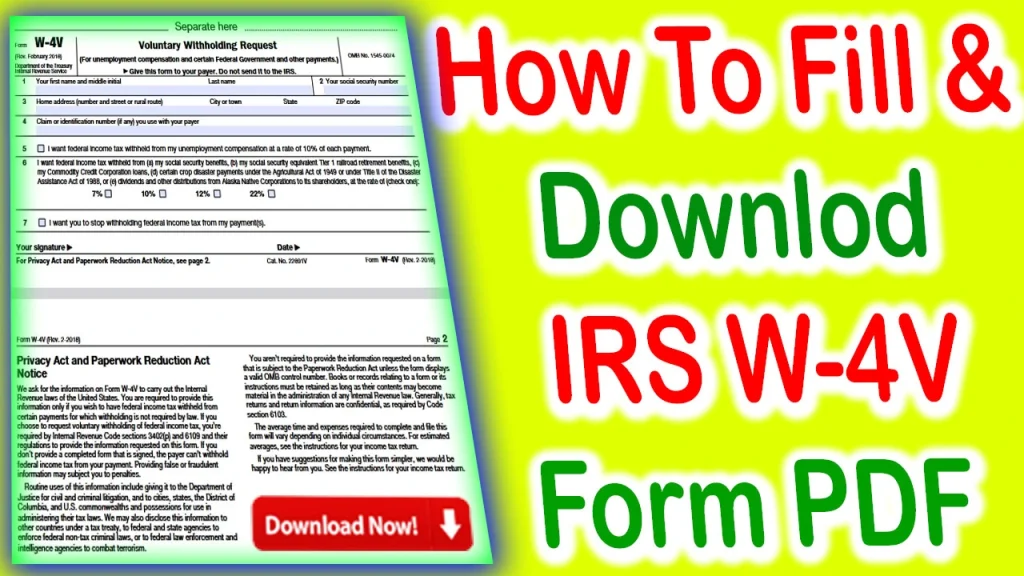

How To Download IRS W-4V Form 2023 PDF

IRS W-4V Form 2023 PDF – Download PDF

IRS W-4V Form 2023 PDF Download – IRS W-4V Form 2023 PDF

If you receive any government payment shown below, you may use this form to ask the payer to withhold federal income tax.

- Unemployment compensation (including Railroad Unemployment Insurance Act (RUIA) payments),

- Social security benefits,

- Social security equivalent Tier 1 railroad retirement benefits,

- Commodity Credit Corporation loans,

- Certain crop disaster payments under the Agricultural Act of 1949 or under Title II of the Disaster Assistance Act of 1988

- Dividends and other distributions from Alaska Native Corporations to its shareholders.

What is the IRS W-4V Form 2023 PDF? – IRS W-4V Form 2023

The IRS W-4V Form 2023 PDF, as mentioned earlier, is formally titled the “Voluntary Withholding Request.” It is a form provided by the Internal Revenue Service (IRS) that allows individuals to specify the amount of federal income tax they want withheld from certain types of payments, such as unemployment compensation, Social Security benefits, or certain government payments.

CMS-40B Form Download 2023

EPA Form 4700-4 PDF Download And Instructions PDF

Why is the IRS W-4V Form 2023 PDF Important?

The IRS W-4V Form 2023 PDF is important because it helps individuals ensure that they are paying the correct amount of federal income tax on the payments they receive. By filling out this form correctly, you can avoid surprises when it comes time to file your income tax return. Moreover, it allows you to tailor your tax withholding to your financial situation, ensuring that you are not overpaying or underpaying taxes.

What Do I Need To Do? – IRS W-4V Form 2023 PDF Download

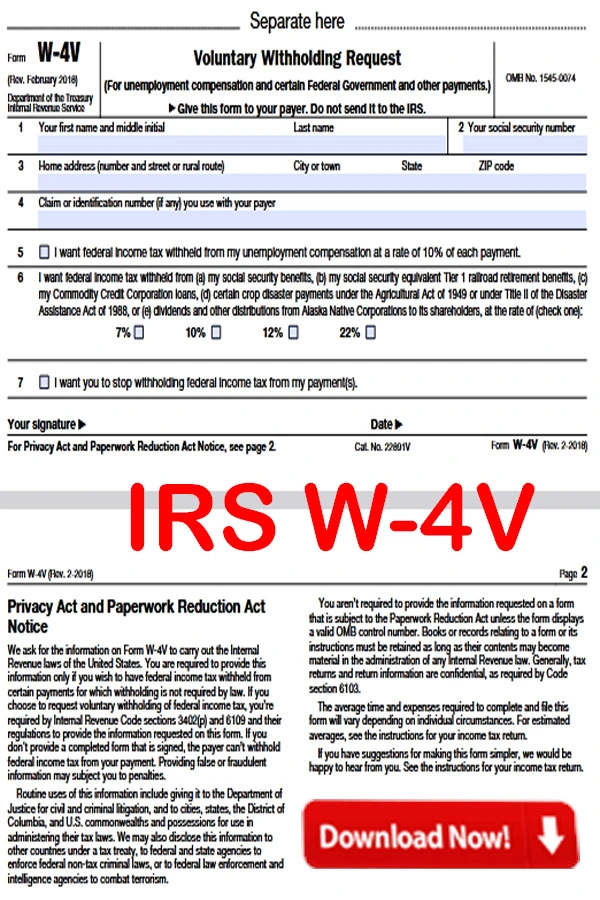

Complete lines 1 through 4; check one box on line 5, 6, or 7; sign Form W-4V; and give it to the payer, not to the IRS.

Note. For withholding on social security benefits, give or send the completed Form W-4V to your local Social Security Administration office.

Line 3. If your address is outside the United States or the U.S. possessions, enter on line 3 the city, province or state, and name of the country. Follow the country’s practice for entering the postal code. Don’t abbreviate the country name.

Line 4. Enter the claim or identification number you use with your payer. For withholding from social security benefits, the claim number is the social security number under which a claim is filed or benefits are paid (for example, 123-45-6789A or 123-45-6789B6). The letter or

letter/number combination suffix that follows the claim number identifies the type of benefit (for example, a wage earner, a spouse, or a widow(er)).

The claim number may or may not be your own social security number. If you are unsure about what number to use, contact the Social Security Administration at 1-800-772-1213 (toll-free). For other government payments, consult your payer for the correct claim or identification number format.

Line 5. If you want federal income tax withheld from your unemployment compensation, check the box on line 5. The payer will withhold 10% from each payment.

Line 6. If you receive any of the payments listed on line 6, check the box to indicate the percentage (7%, 10%, 12%, or 22%) you want withheld from each payment.

Line 7. See How Do I Stop Withholding? below.

Sign this form. Form W-4V is not considered valid unless you sign it.

When Will My Withholding Start? – IRS W-4V Form 2023 PDF

Ask your payer exactly when income tax withholding will begin. The federal income tax withholding you choose on this form will remain in effect until you change or stop it or the payments stop.

How Do I Change Withholding?

If you are getting a payment other than unemployment compensation and want to change your withholding rate, complete a new Form W-4V. Give the new form to the payer.

How Do I Stop Withholding?

If you want to stop withholding, complete a new Form W-4V. After completing lines 1 through 4, check the box on line 7, and sign and date the form; then give the new form to the payer.

SF-424B Form PDF Download

Form SF 424 PDF Download

Key Terms Associated with the IRS W-4V Form 2023 PDF

In this section, we will define and explain some key terms that you will encounter when dealing with the IRS W-4V Form 2023 PDF:

- Withholding: Withholding refers to the amount of money that is deducted from your payments, such as wages or benefits, to cover your federal income tax liability.

- Voluntary Withholding: The term “voluntary” in the form’s title indicates that withholding is optional for certain payments, and individuals can choose to have tax withheld or not.

- Unemployment Compensation: This is a type of payment that individuals receive when they lose their jobs and meet certain eligibility criteria. It is subject to federal income tax.

- Social Security Benefits: Social Security benefits are payments made to retirees, disabled individuals, and survivors. The IRS can tax a portion of these benefits if your income exceeds a certain threshold.

- Government Payments: Government payments include various types of payments made by federal, state, or local government agencies. These payments may be subject to federal income tax.

When to Use the IRS W-4V Form 2023 PDF

In this chapter, we will discuss the specific situations in which you should use the IRS W-4V Form 2023 PDF. It is essential to understand when and why this form is applicable.

Use of the IRS W-4V Form for Unemployment Compensation

If you are receiving unemployment compensation, you may want to use the IRS W-4V Form 2023 PDF to specify how much federal income tax you want withheld from your payments. This can help you avoid owing a substantial tax bill when you file your tax return.

Use of the IRS W-4V Form for Social Security Benefits

For individuals receiving Social Security benefits, the IRS W-4V Form 2023 PDF can be used to request voluntary withholding. While not everyone who receives Social Security benefits is required to pay federal income tax on them, some individuals with higher incomes may owe taxes on a portion of their benefits. By using this form, you can choose to have taxes withheld to cover potential tax liabilities.

Use of the IRS W-4V Form for Government Payments

Government payments, such as payments from state or local governments, may also be subject to federal income tax. If you are receiving such payments, you can use the IRS W-4V Form 2023 PDF to specify your withholding preferences.

How to Fill Out IRS W-4V Form 2023 PDF

In this chapter, we will provide detailed instructions on how to properly fill out the IRS W-4V Form 2023 PDF. We will break down each section of the form, explaining what information is required and how to complete it accurately.

Section 1: Your Information

The first section of the form requires you to provide your personal information, including your name, address, Social Security Number (SSN), and filing status. It is crucial to ensure that this information is accurate and up to date.

Section 2: Request for Voluntary Withholding

In this section, you will specify the type of payment for which you are requesting voluntary withholding. You will also indicate whether you want to start or stop the withholding and the effective date for the change.

Section 3: Sign and Date

The final section of the form is for your signature and date. By signing the form, you certify that the information provided is correct and that you understand the implications of your withholding choices.

IRS Form 5500 PDF Download

FHA Loan Application | FHA Loan First Time Home Buyer

Implications of Your Withholding Choices

In this chapter, we will discuss the implications of the choices you make on the IRS W-4V Form 2023 PDF. It’s essential to understand how your decisions can impact your tax liability and financial situation.

Choosing to Have Taxes Withheld

If you choose to have taxes withheld from your payments, it can be a convenient way to ensure that you have funds set aside to cover your tax liability. This can help you avoid owing a significant amount when you file your tax return.

Choosing Not to Have Taxes Withheld

Alternatively, you may opt not to have taxes withheld from your payments. While this provides you with more immediate cash, it also means that you will need to set aside money on your own to cover your tax obligations. Failure to do so could result in a tax bill and potential penalties when you file your return.

Tax Liability and Planning

Your withholding choices should be based on your overall tax liability and financial situation. Factors such as your total income, other sources of income, deductions, and credits should all be considered when deciding how much to withhold. It may be beneficial to consult with a tax professional to determine the appropriate withholding amount.

Submitting the IRS W-4V Form 2023 PDF

In this chapter, we will discuss how to submit the completed IRS W-4V Form 2023 PDF to the appropriate authorities. We will cover submission methods and important considerations.

Submission Methods

You can submit the IRS W-4V Form 2023 PDF through various methods:

- Online: Some agencies may offer online submission options, allowing you to fill out and submit the form electronically.

- Mail: You can print the form, fill it out manually, and mail it to the relevant agency. The address for submission can typically be found on the agency’s website or in the form’s instructions.

- In-Person: In some cases, you may be able to submit the form in person at a local government office.

Timely Submission

It is essential to submit the form in a timely manner to ensure that your withholding preferences are applied correctly to your payments. Be aware of any deadlines or specific requirements set by the paying agency.

Common Mistakes to Avoid

To help individuals avoid errors when completing the IRS W-4V Form, this section will highlight common mistakes and misconceptions. It will provide tips on how to avoid these pitfalls and ensure that the form is submitted correctly.

Monitoring and Adjusting Withholding

After submitting the IRS W-4V Form, individuals may need to monitor and potentially adjust their withholding preferences. This section will explain when and how to make changes to the form if circumstances change, such as changes in income or tax liability.

Tax Implications and Benefits

Here, we will discuss the tax implications of using the IRS W-4V Form, including how withholding affects tax liability and potential tax refunds. We will also touch on the benefits of voluntary withholding for those who prefer to pay their taxes gradually.

IRS My Account Login & Create Account | @irs.gov Login

I-9 form 2023 PDF Download

Conclusion – IRS W-4V Form 2023 PDF Download

IRS W-4V Form 2023 PDF Download : In conclusion, the IRS W-4V Form 2023 PDF is a valuable tool for individuals receiving Social Security benefits and other government payments. Understanding how to complete and submit this form correctly can help individuals manage their tax obligations effectively and avoid unnecessary complications. By following the guidelines and information provided in this comprehensive guide, individuals can make informed decisions about their federal income tax withholding preferences.