Florida medicaid eligibility income chart 2023 pdf, Florida medicaid eligibility income chart 2023 for seniors, Florida medicaid eligibility income chart 2023 for child, florida medicaid income limits 2023 family of 4, florida medicaid income limits 2023 family of 3, Florida Medicaid Eligibility Income Chart 2023, florida medicaid income limits 2023 family of 5, florida medicaid income limits 2023 family of 2, florida medicaid income limits 2023 family of 6

Florida Medicaid Long-Term Care Definition

Medicaid is a health care program for low-income individuals of any age. Although there are various coverage groups, this page focuses on long-term care Medicaid eligibility for Florida senior residents (ages 65 and older). In addition to care services in nursing homes, adult family care homes (adult foster care homes), and assisted living facilities, FL Medicaid pays for non-medical services and to help vulnerable seniors stay in their homes. helps. There are three categories of Medicaid long-term care programs for which FL seniors may be eligible.

Institutional / Nursing Home Medicaid – This is an entitlement program; anyone who is eligible will receive assistance. Benefits are provided only in nursing homes.

Medicaid Waiver / Home and Community Based Services (HCBS) – These services are not an entitlement; the number of persons who can receive these services is limited and waiting lists for some services may exist. Intended to delay nursing home admissions, long-term care benefits are provided at home, adult day care, in adult foster care homes, and in assisted living residences via a managed care system.

Regular Medicaid / Medicaid for Aged and Disabled (MEDS-AD) – This is an entitlement program; all persons who are eligible will receive services. Limited long-term care services, such as personal care assistance or adult day care, may be available.

Medicaid in Florida is sometimes called the Statewide Medicaid Managed Care (SMMC) program. The Medicaid managed care program for long-term care services for the elderly and disabled is called the Long-term Care (LTC) program. All other health care services outside of long-term care are provided via the Managed Medical Assistance (MMA) program. While Medicaid is jointly funded by the state and federal government, it is administered by the state. The Agency for Healthcare Administration is the state’s administering agency.

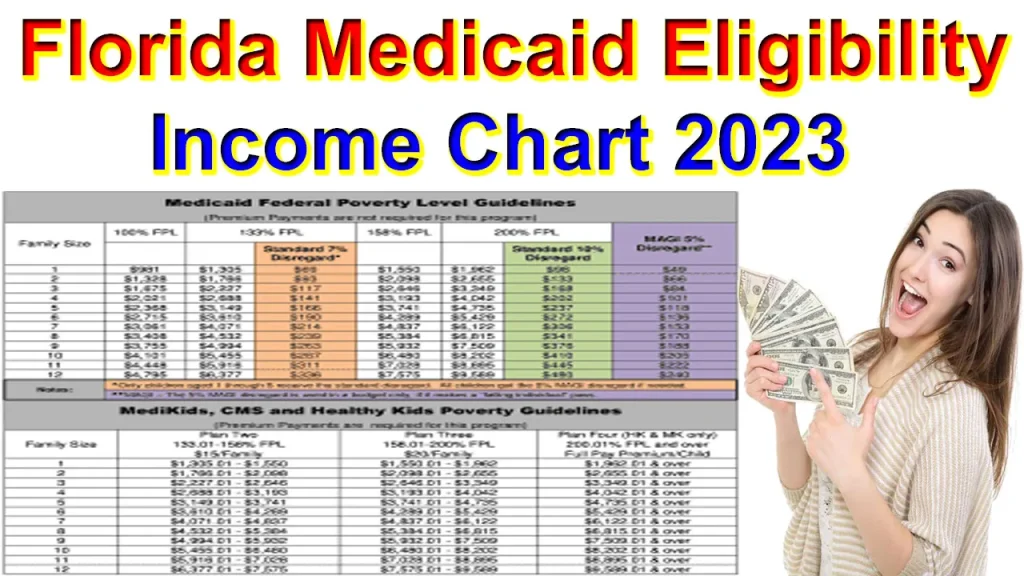

Florida Medicaid Eligibility Income Chart 2023

Income & Asset Limits for Florida Eligibility : The three categories of Medicaid long-term care programs have varying financial and medical eligibility criteria. Financial requirements change annually, vary based on marital status, and is further complicated by the fact that Florida offers alternative pathways toward eligibility.

Simplified Eligibility Criteria: Single Applicant for Nursing Home Care : Florida seniors must be financially and medically eligible for long-term care Medicaid. They must have limited income, limited assets, and a medical need for care. A single individual applying for Nursing Home Medicaid in 2023 in FL must meet the following criteria: 1) Have income under $2,742 / month 2) Have assets under $2,000 3) Require the level of care provided in a nursing home facility.

The table below provides a quick reference to allow seniors to determine if they might be immediately eligible for long-term care from a Florida Medicaid program. Alternatively, one may take the Medicaid Eligibility Test. IMPORTANT: Not meeting all the criteria does not mean one is ineligible or cannot become eligible for Medicaid in Florida.

Florida Medicaid Eligibility Income Chart 2023

| 2023 Florida Medicaid Long-Term Care Eligibility for Seniors | |||||||||

| Type of Medicaid | Single | Married (both spouses applying) | Married (one spouse applying) | ||||||

| Income Limit | Asset Limit | Level of Care Required | Income Limit | Asset Limit | Level of Care Required | Income Limit | Asset Limit | Level of Care Required | |

| Institutional / Nursing Home Medicaid | $2,742 / month* | $2,000 | Nursing Home | $5,484 / month ($2,742 / month per spouse)* | $3,000 | Nursing Home | $2,742 / month for applicant* | $2,000 for applicant & $148,620 for non-applicant | Nursing Home |

| Medicaid Waiver / Home and Community Based Services | $2,742 / month† | $2,000 | Nursing Home | $5,484 / month ($2,742 / month per spouse)† | $3,000 | Nursing Home | $2,742 / month for applicant† | $2,000 for applicant & $148,620 for non-applicant | Nursing Home |

| Regular Medicaid / Medicaid for Aged and Disabled | $1,084 / month (eff. 4/1/23 – 3/31/24) | $5,000 | Help with ADLs | $1,460 / month (eff. 4/1/23 – 3/31/24) | $6,000 | Help with ADLs | $1,460 / month (eff. 4/1/23 – 3/31/24) | $6,000 | Help with ADLs |

*All of a recipient’s monthly income, minus a monthly Personal Needs Allowance of $160, Medicare premiums, and potentially a Monthly Maintenance Needs Allowance for a non-applicant spouse, must be paid to the nursing home.

†Based on one’s living setting, a program beneficiary may not be able to keep monthly income up to this level.

Florida Medicaid Income Definition & Exceptions

Countable vs. Non-Countable Income

For Medicaid eligibility purposes, nearly any income from any source that a Medicaid applicant receives is counted towards the limit. Examples include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, IRA withdrawals, stock dividends, and Veteran’s benefits with the exception of Aid & Attendance pension. Holocaust restitution payments are also considered non-countable income.

Treatment of Income for a Couple

When only one spouse of a married couple applies for Institutional Medicaid or home and community based services, only the income of the applicant is counted. This means the income of the non-applicant spouse is disregarded and does not impact the income eligibility of their spouse. The non-applicant spouse, however, may be entitled to a Minimum Monthly Maintenance Needs Allowance (MMMNA) from their applicant spouse.

The MMMNA is a Spousal Impoverishment Rule and is the minimum amount of monthly income a non-applicant spouse is said to require to avoid spousal impoverishment. The MMMNA is $2,465 (eff. 7/1/23 – 6/30/24). If a non-applicant’s monthly income is under $2,465, income can be transferred from their applicant spouse, bringing their income up to this level.

In Florida, a non-applicant spouse can further increase their Spousal Income Allowance if their housing and utility costs exceed a “shelter standard” of $739.50 / month (eff. 7/1/23 – 6/30/24). However, in 2023, a Spousal Income Allowance cannot push a non-applicant’s monthly income over $3,716. This is the Maximum Monthly Maintenance Needs Allowance. More on how this is calculated.

Income is counted differently when only one spouse applies for Regular Medicaid; the income of both the applicant spouse and the non-applicant spouse is calculated towards the applicant’s income eligibility. Furthermore, there is no Monthly Maintenance Needs Allowance for the non-applicant spouse. More on how Medicaid counts income.

Medicaid Eligibility Income Chart by State – (Updated Jul. 2023)

Florida Medicaid Eligibility Income Chart 2023 : The table below shows Medicaid’s monthly income limits by state for seniors. Income is not the only eligibility factor for Medicaid long-term care; there is also an asset limit and level of care requirement. Additionally, there are state-specific details. Click on the state name below to see that state’s complete Medicaid eligibility criteria.

A free, non-binding Medicaid Eligibility Test is available here. This test takes approximately 3 minutes to complete.

The maximum income limits change dependent on the marital status of the applicant, whether a spouse is also applying for Medicaid, and the type of Medicaid for which they are applying. Nursing Home Medicaid may have a different income limit than home and community based Medicaid services, and both of those may differ from the Aged, Blind and Disabled income limits.

Exceeding the income limit does not mean an individual cannot qualify for Medicaid. Most states have multiple pathways to Medicaid eligibility, such as a Medically Needy Pathway. Furthermore, many states allow the use of Miller Trusts or Qualified Income Trusts to help persons who cannot afford their care costs to become income eligible for Medicaid. There are also Medicaid Planning Professionals that employ other complicated techniques to help persons become eligible. Finally, candidates can take advantage of Spousal Protection Laws that allow income (and assets) to be allocated to a non-applicant spouse.

VA Form 21-4138 PDF Download Fill Online, Printable, Fillable Guide

What Happens to One’s Income When They Enter a Nursing Home

While persons residing in Medicaid-funded nursing homes are permitted to have monthly income as high as $2,742 in 2023 (in most states), they are not permitted to keep all of it. Instead, nearly all of their income except for a Personal Needs Allowance (which ranges for $30 – $200 / month), must go towards paying for their cost of care. Often, the nursing home coordinates directly with Social Security so the income they would have otherwise received goes straight to the nursing home.

What Happens to One’s Income When They Qualify for a Medicaid HCBS Waiver

When persons receive Medicaid long-term care at home or “in the community” (outside of a nursing home) through a Medicaid Waiver, they still have expenses that must be paid. Rent, food, and utilities, as an example, are expenses that end when one is in a nursing home, but continue when one receives Medicaid at home. Therefore, Medicaid beneficiaries that receive assistance through a Medicaid HCBS Waiver are permitted to keep their monthly income (up to a certain amount) to pay those expenses.

Should one’s income exceed the limits in the table below, it may still be possible to qualify for Medicaid through working with a Medicaid Planner. Find a Planner that provides services in your area.

Florida Medicaid Eligibility Income Chart 2023

| 2023 Medicaid Eligibility Income Chart – Updated July 2023 | ||||

| State | Type of Medicaid | Single | Married (both spouses applying) | Married (one spouse applying) |

| Alabama | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Alabama | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Alabama | Regular Medicaid / Medicaid for Elderly and Disabled | $934 / month | $1,391 / month | $1,391 / month |

| Alaska | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Alaska | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Alaska | Regular Medicaid / Aged Blind and Disabled | $1,697 / month | $2,513 / month | $2,513 / month |

| Arizona | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Arizona | Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Arizona | Regular Medicaid / Aged Blind and Disabled | $1,215 / month (eff. 2/23 – 1/24) | $1,644 / month (eff. 2/23 – 1/24) | $1,644 / month (eff. 2/23 – 1/24) |

| Arkansas | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Arkansas | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Arkansas | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| California | Institutional / Nursing Home Medicaid | No income limit, but resident is only permitted to keep $35 / month. | No income limit, but resident is only permitted to keep $35 / month. | No income limit, but resident is only permitted to keep $35 / month. |

| California | Medicaid Waivers / Home and Community Based Services | $1,677 / month (eff. 4/23 – 3/24) | $2,269 / month (eff. 4/23 – 3/24) | $1,677 / month for applicant (eff. 4/23 – 3/24) |

| California | Regular Medicaid / Aged Blind and Disabled | $1,677 / month (eff. 4/23 – 3/24) | $2,269 / month (eff. 4/23 – 3/24) | $2,277 / month (eff. 4/23 – 3/24) |

| Colorado | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Colorado | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Colorado | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Connecticut | Institutional / Nursing Home Medicaid | Income must be less than the cost of nursing home | Income must be less than the cost of nursing home | Income must be less than the cost of nursing home |

| Connecticut | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Connecticut | Regular Medicaid / Aged Blind and Disabled | $1,182 / month (eff. 7/23 – 6/24) | $1,910 / month (eff. 7/23 – 6/24) | $1,428 / month (eff. 7/23 – 6/24) |

| Delaware | Institutional / Nursing Home Medicaid | $2,285 / month | $4,570 / month | $2,285 / month for the applicant |

| Delaware | Home and Community Based Services / Long Term Care Community Services | $2,285 / month | $4,570 / month | $2,285 / month for the applicant |

| Delaware | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Florida | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Florida | Home and Community Based Services |

$2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Florida | Regular Medicaid / Medicaid for Aged and Disabled | $1,084 / month (eff. 4/23 – 3/24) | $1,460 / month (eff. 4/23 – 3/24) | $1,460 / month (eff. 4/23 – 3/24) |

| Georgia | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Georgia | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Georgia | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Hawaii | Institutional / Nursing Home Medicaid | No hard income limit. One’s entire income except for $50 / month must go towards cost of care. | No hard income limit. Each spouse’s entire income except for $50 / month must go towards cost of care. | No hard income limit. Applicant’s entire income except for $50 / month must go towards cost of care. |

| Hawaii | Home and Community Based Services | If one lives at home $1,398 / month (eff. 3/23 – 2/24) | Each spouse is considered separately. If they are living at home, each spouse can have up to $1,398 / month. (eff. 3/23 – 2/24) | If one lives at home, applicant income limit of $1,398 / month (eff. 3/23 – 2/24) |

| Hawaii | Regular Medicaid / Aged Blind and Disabled | $1,398 / month (eff. 3/23 – 2/24) | $1,890 / month (eff. 3/23 – 2/24) | $1,890 / month (eff. 3/23 – 2/24) |

| Idaho | Institutional / Nursing Home Medicaid | $2,762 / month | $5,504 / month | $2,762 / month for applicant |

| Idaho | Medicaid Waivers / Home and Community Based Services | $2,762 / month | $5,504 / month | $2,762 / month for applicant |

| Idaho | Regular Medicaid / Aged Blind and Disabled | $967 / month | $1,391 / month | $1,391 / month |

| Illinois | Institutional / Nursing Home Medicaid | $1,215 / month (eff. 4/23 – 3/24) | $1,643 / month (eff. 4/23 – 3/24) | $1,215 / month for applicant (eff. 4/23 – 3/24) |

| Illinois | Medicaid Waivers / Home and Community Based Services | $1,215 / month (eff. 4/23 – 3/24) | $1,643 / month (eff. 4/23 – 3/24) | $1,215 / month for applicant (eff. 4/23 – 3/24) |

| Illinois | Regular Medicaid / Aid to Aged Blind and Disabled | $1,215 / month (eff. 4/23 – 3/24) | $1,643 / month (eff. 4/23 – 3/24) | $1,643 / month (eff. 4/23 – 3/24) |

| Indiana | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Indiana | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Indiana | Traditional Medicaid / Aged Blind and Disabled | $1,215 / month (eff. 3/23 – 2/24) | $1,643 / month (eff. 3/23 – 2/24) | $1,643 / month (eff. 3/23 – 2/24) |

| Iowa | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Iowa | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Iowa | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Kansas | Institutional / Nursing Home Medicaid | No set income limit. Income over $62 / month must be paid towards one’s cost of care. | No set income limit. Income over $62 / month (per spouse) must be paid towards one’s cost of care. | No set income limit. Applicant’s income over $62 / month must be paid towards one’s cost of care. |

| Kansas | Medicaid Waivers / Home and Community Based Services | No set income limit. Income over $2,742 / month must be paid towards one’s cost of care. | No set income limit. Income over $2,742 / month (per spouse) must be paid towards one’s cost of care. | No set income limit. Applicant’s income over $2,742 / month must be paid towards one’s cost of care. |

| Kansas | Regular Medicaid / Aged Blind and Disabled | $475 / month | $475 / month | $475 / month |

| Kentucky | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Kentucky | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Kentucky | Regular Medicaid / Aged Blind and Disabled | $235 / month | $291 / month | $291 / month |

| Louisiana | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Louisiana | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Louisiana | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Maine | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Maine | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Maine | Regular Medicaid / Aged Blind and Disabled | $1,215 / month | $1,644 / month | $1,644 / month |

| Maryland | Institutional / Nursing Home Medicaid | Cannot exceed the cost of nursing home care | Cannot exceed the cost of nursing home care | Applicant’s income cannot exceed the cost of nursing home care |

| Maryland | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Maryland | Regular Medicaid / Aged Blind and Disabled | $350 / month | $392 / month | $392 / month |

| Massachusetts | Institutional / Nursing Home Medicaid | $1,215 / month (eff. 3/23 – 2/24) | $1,643 / month (eff. 3/23 – 2/24) | $1,215 / month for applicant (eff. 3/23 – 2/24) |

| Massachusetts | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Massachusetts | Regular Medicaid / Aged Blind and Disabled | $1,215 / month (eff. 3/23 – 2/24) | $1,643 / month (eff. 3/23 – 2/24) | $1,643 / month (eff. 3/23 – 2/24) |

| Michigan | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Michigan | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Michigan | Regular Medicaid / Aged Blind and Disabled | $1,215 / month | $1,643 / month | $1,643 / month |

| Minnesota | Institutional / Nursing Home Medicaid | $1,215 / month (eff. 7/23-6/24) | $1,644 / month (eff. 7/23-6/24) | $1,215 / month for applicant (eff. 7/23-6/24) |

| Minnesota | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Minnesota | Regular Medicaid / Elderly Blind and Disabled | $1,215 / month (eff. 7/23 – 6/24) | $1,643 / month (eff. 7/23-6/24) | $1,643 / month (eff. 7/23-6/24) |

| Mississippi | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Mississippi | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Mississippi | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Missouri | Institutional / Nursing Home Medicaid | All available income except for $50 / month must be paid towards care | All available income except for $50 / month must be paid towards care | All applicant’s available income except for $50 / month must be paid towards care |

| Missouri | Medicaid Waivers / Home and Community Based Services | $1,598 / month | $3,196 / month ($1,598 / month per spouse) | $1,598 / month for applicant |

| Missouri | Regular Medicaid / Aged Blind and Disabled | $1,033 / month for Aged & Disabled (eff 4/23 – 3/24). $1,215 / month for Blind (eff 4/23 – 3/24). | $1,397 / month for Aged & Disabled (eff 4/23 – 3/24). $1,644 / month for Blind (eff 4/23 – 3/24). | $1,397 / month for Aged & Disabled (eff 4/23 – 3/24). $1,644 / month for Blind (eff 4/23 – 3/24). |

| Montana | Institutional / Nursing Home Medicaid | Income must be equal or less than the cost of nursing home care | Income must be equal or less than the cost of nursing home care | Applicant’s income must be equal or less than the cost of nursing home care |

| Montana | Medicaid Waivers / Home and Community Based Services |

$914 / month | $1,828 / month ($914 / month per spouse) | $914 / month for applicant |

| Montana | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Nebraska | Institutional / Nursing Home Medicaid | $1,215 / month | $1,643 / month | $1,215 / month for applicant |

| Nebraska | Medicaid Waivers / Home and Community Based Services | $1,215 / month | $1,643 / month | $1,215 / month for applicant |

| Nebraska | Regular Medicaid / Aged Blind and Disabled | $1,215 / month | $1,643 / month | $1,643 / month |

| Nevada | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Nevada | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Nevada | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| New Hampshire | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| New Hampshire | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| New Hampshire | Regular Medicaid / Old Age Assistance | $928 / month | $1,372 / month | $1,372 / month |

| New Jersey | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| New Jersey | Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| New Jersey | Regular Medicaid / Aged Blind and Disabled | $1,215 / month | $1,643 / month | $1,643 / month |

| New Mexico | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| New Mexico | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| New Mexico | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| New York | Institutional / Nursing Home Medicaid | $1,677 / month | $2,268 / month | $1,677 / month for applicant |

| New York | Medicaid Waivers / Home and Community Based Services | $1,677 / month | $2,268 / month | $1,677 / month for applicant |

| New York | Regular Medicaid / Aged Blind and Disabled | $1,677 / month | $2,268 / month | $2,268 / month |

| North Carolina | Institutional / Nursing Home Medicaid | Must be less than the amount Medicaid pays for nursing home care (est. $6,381 – $9,087 / mo.) | Must be less than the amount Medicaid pays for nursing home care (est. $6,381 – $9,087 / mo.) | Applicant’s income must be less than the amount Medicaid pays for nursing home care (est. $6,381 – $9,087 / mo.) |

| North Carolina | Medicaid Waivers / Home and Community Based Services | $1,215 / month (eff. 4/23 – 3/24) | $1,644 / month (eff. 4/23 – 3/24) | $1,215 / month (eff. 4/23 – 3/24) |

| North Carolina | Regular Medicaid / Aged Blind and Disabled | $1,215 / month (eff. 4/23 – 3/24) | $1,644 / month (eff. 4/23 – 3/24) | $1,644 / month (eff. 4/23 – 3/24) |

| North Dakota | Institutional / Nursing Home Medicaid | No set limit. Applicant is allowed $65 for personal needs and the remaining income goes towards the cost of care. | No set limit. Couple is allowed $130 for personal needs. The remaining income goes towards the cost of care. | No set limit. Applicant is allowed $65 for personal needs and the remaining income goes towards the cost of care |

| North Dakota | Medicaid Waivers / Home and Community Based Services | $1,009 / month (eff. 4/23 – 3/24) | $1,364 / month (eff. 4/23 – 3/24) | $1,009 / month (eff. 4/23 – 3/24) |

| North Dakota | Regular Medicaid / Aged Blind and Disabled | $1,009 / month (eff. 4/23 – 3/24) | $1,364 / month (eff. 4/23 – 3/24) | $1,364 / month (eff. 4/23 – 3/24) |

| Ohio | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Ohio | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Ohio | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Oklahoma | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Oklahoma | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Oklahoma | Regular Medicaid / Aged Blind and Disabled | $1,215 / month | $1,643 / month | $1,643 / month |

| Oregon | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Oregon | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Oregon | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Pennsylvania | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Pennsylvania | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Pennsylvania | Regular Medicaid / Aged Blind and Disabled | $936.10 / month | $1,404.30 / month | $1,404.30 / month |

| Rhode Island | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Rhode Island | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Rhode Island | Regular Medicaid / Elders and Adults with Disabilities (EAD) | $1,215 / month | $1,643 / month | $1,643 / month |

| South Carolina | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| South Carolina | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| South Carolina | Regular Medicaid / Aged Blind or Disabled | $1,215 / month (eff 3/23 – 2/24) | $1,643 / month (eff 3/23 – 2/24) | $1,643 / month (eff 3/23 – 2/24) |

| South Dakota | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| South Dakota | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| South Dakota | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Tennessee | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Tennessee | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Tennessee | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Texas | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Texas | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Texas | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Utah | Institutional / Nursing Home Medicaid | No income limit. One’s monthly income determines how much one must pay towards the cost of care. | No income limit. Each spouse’s monthly income determines how much each spouse must pay towards the cost of care. | No income limit. Applicant’s monthly income determines how much one must pay towards the cost of care. |

| Utah | Medicaid Waivers / Home and Community Based Services | Aging Waiver ($1,215 / month – eff. 3/23 – 2/24) New Choices Waiver ($2,742 / month) | Aging Waiver (Each spouse is allowed up to $1,215 / month – eff. 3/23 – 2/24) New Choices Waiver (Each spouse is allowed up to $2,742 / month) | Aging Waiver ($1,215 / month for applicant – eff. 3/23 – 2/24) New Choices Waiver ($2,742 / month for applicant) |

| Utah | Regular Medicaid / Aged Blind and Disabled | $1,215 / month (eff. 3/23 – 2/24) | $1,643 / month (eff. 3/23 – 2/24) | $1,643 / month (eff. 3/23 – 2/24) |

| Vermont | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Vermont | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Vermont | Regular Medicaid / Aged Blind and Disabled (outside Chittenden County) | $1,258 / month | $1,258 / month | $1,258 / month |

| Regular Medicaid / Aged Blind and Disabled (in Chittenden County) | $1,358 / month | $1,358 / month | $1,358 / month | |

| Virginia | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Virginia | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Virginia | Regular Medicaid / Aged Blind and Disabled | $972 / month | $1,314 / month | $1,314 / month |

| Washington | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Washington | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Washington | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Washington, DC | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Washington, DC | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Washington, DC | Regular Medicaid / Aged Blind and Disabled | $1,215 / month | $1,643 / month | $1,643 / month |

| West Virginia | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| West Virginia | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| West Virginia | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

| Wisconsin | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Wisconsin | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Wisconsin | Regular Medicaid / Elderly Blind and Disabled (EBD) | $997.78 / month | $1,503.05 / month | $1,503.05 / month |

| Wyoming | Institutional / Nursing Home Medicaid | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Wyoming | Medicaid Waivers / Home and Community Based Services | $2,742 / month | $5,484 / month ($2,742 / month per spouse) | $2,742 / month for applicant |

| Wyoming | Regular Medicaid / Aged Blind and Disabled | $914 / month | $1,371 / month | $1,371 / month |

Asset Definition & Exceptions | Florida Medicaid Eligibility Income Chart 2023

Countable vs. Non-Countable Assets

Countable assets are counted towards the income limit and include cash, stocks, bonds, investments, bank accounts (credit union, savings, and checking), any remaining Covid-19 stimulus checks, and real estate in which one does not reside. There are also many assets that Medicaid considers to be exempt (non-countable). Exemptions include personal belongings, household furnishings, an automobile, irrevocable burial trusts, IRAs in payout status, and generally one’s primary home.

Home Exemption Rules

For home exemption, the Medicaid applicant must live in their home or have Intent to Return, and in 2023, have a home equity interest no greater than $688,000. Equity interest is the amount of the home’s value owned by the applicant after subtracting any home debt. If a non-applicant spouse lives in the home, it is exempt regardless of any other circumstances. For seniors applying for Regular Medicaid, there is no home equity interest limit.

other than compensation what benefits come with va disabilities?

While one’s home is generally exempt from Medicaid’s asset limit, it is not exempt from Medicaid’s Estate Recovery Program. Following a long-term care Medicaid beneficiary’s death, Florida’s Medicaid agency attempts reimbursement of care costs through whatever estate of the deceased still remains. This is often the home. Without proper planning strategies in place, the home will be used to reimburse Medicaid for providing care rather than going to family as inheritance.

Treatment of Assets for a Couple

All assets of a married couple are considered jointly owned. This is true regardless of the long-term care Medicaid program for which one is applying and regardless of if one or both spouses are applicants. However, the non-applicant spouse of a Medicaid nursing home or home and community based services applicant is permitted a Community Spouse Resource Allowance (CSRA).

In 2023, this Spousal Impoverishment Rule allows the community spouse (the non-applicant spouse) to retain up to $148,620 of the couple’s assets. There is no CSRA for a non-applicant spouse of a Regular Medicaid applicant.

Medicaid’s Look-Back Rule

Florida has a 60-month Medicaid Look-Back Period that immediately precedes one’s Medicaid nursing home or home and community based services application date. During the “look back”, Medicaid checks to ensure no assets were gifted or sold under fair market value. This includes assets transferred by one’s spouse. The Look-Back Rule is intended to prevent persons from giving away assets to meet Medicaid’s asset limit.

If one violates this rule, a Penalty Period of Medicaid ineligibility will ensue. There is no Look-Back Period for Regular Medicaid applicants. The U.S. Federal Gift Tax Rule does not extend to Medicaid eligibility. In 2023, the Gift Tax Rule allows one to gift up to $17,000 per recipient without filing a gift tax return. Gifting under this rule violates Medicaid’s Look-Back Period.

Medical / Functional Need Requirements

For Florida long-term care Medicaid, an applicant must have a medical need for such care. For Nursing Home Medicaid and home and community based services to delay the need for institutionalization, a Nursing Facility Level of Care (NFLOC) is required. Furthermore, some benefits may require additional eligibility criteria be met.

As an example, for respite care, an inability to be left at home without supervision might be necessary. For long-term care services via the Regular Medicaid program, a functional need with the Activities of Daily Living (ADLs) is required, but a NFLOC is not necessarily required.

VA Disability Rates 2023 | 2023 VA Disability Pay Rates & Charts

Qualifying When Over the Limits

Florida Medicaid Eligibility Income Chart 2023 : For Florida residents, aged 65 and over, who do not meet the financial eligibility requirements above, there are other ways to qualify for Medicaid.

Florida has a “Share of Cost” Program, also called a “Spend-Down” Program, for persons who apply for Regular Medicaid / Medicaid for Aged and Disabled (MEDS-AD) and have income over the Medicaid limit. This program allows persons to become income-eligible for Medicaid services by spending the majority of their income on medical bills (i.e., health insurance costs, such as Medicare premiums, and medical service bills).

In 2023, the Medically Needy Income Limit (MNIL) in FL is $180 / month for a single applicant and $241 / month for a married couple. The “spend-down” amount is the difference between one’s monthly income and the MNIL. Once the “spend down” is met, one will be income-eligible for the remainder of the month. The Medically Needy Asset Limit is $5,000 for an individual and $6,000 for a couple.

Qualified Income Trusts (QITs) –

Also called Miller Trusts, QITs offer a way for persons over the Medicaid income limit to still qualify for Nursing Home Medicaid or home and community based services. With this type of irrevocable trust, a sufficient amount of money must be deposited into the account each month to bring the individual’s income down to the Medicaid income limit.

Irrevocable means the terms of the trust cannot be changed or canceled. A trustee is named and legally controls trust funds, which can only be used for very specific purposes. Examples include paying medical bills, personal needs allowances, and Medicare premiums. The state of Florida must be named to receive any remaining trust funds upon the death of the Medicaid recipient.

Asset Spend Down –

Persons who have countable assets over FL’s asset limit can “spend down” assets and become asset-eligible. This can be done by spending excess assets on non-countable ones. Examples include making home modifications, like the addition of wheelchair ramps or stair lifts, prepaying funeral and burial expenses, and paying off debt.

Remember, assets cannot be gifted or sold under fair market value. Doing so violates Medicaid’s Look-Back Rule and can result in a Penalty Period of Medicaid ineligibility. It is recommended one keep documentation of how assets were spent as proof this rule was not violated.

Our Florida Medicaid Spend Down Calculator can assist persons in determining if they might have a spend down, and if so, provide an estimate of the amount.

Medicaid Planning –

The majority of persons considering Medicaid are “over-income” and / or “over-asset”, but they still cannot afford their cost of care. For these persons, Medicaid planning exists. By working with a Medicaid Planning Professional, families can employ a variety of strategies to help them become Medicaid eligible, as well as to protect their home from Medicaid’s Estate Recovery Program. Connect with a Medicaid Planner.

3 Types of Temporary Total Disability Ratings – Hospitalization VA Ratings

Specific Florida Medicaid Programs

Florida Medicaid Eligibility Income Chart 2023 : In addition to paying for nursing home care, Florida Medicaid offers the following programs relevant to the elderly that helps them to remain living at home, in adult foster care homes, or in assisted living residences.

Florida’s Statewide Medicaid Managed Care (SMMC) Long-Term Care (LTC) Program –

Former HCBS Medicaid Waivers, such as the Alzheimer’s Disease Waiver, Nursing Home Diversion Waiver, Assisted Living for the Elderly (ALE) Waiver, and the Consumer Directed Care Plus (CDC+) Waiver, have all been discontinued and replaced with the SMMC-LTC Program. Most of the services and benefits that were available under the older waiver system have been preserved with the new Medicaid managed care model. Benefits may include adult day health care, meal delivery, respite care, personal emergency response systems, and personal care assistance, to name a few.

Program of All-Inclusive Care for the Elderly (PACE) –

The benefits of Medicaid, including long-term care, and Medicare are combined into a single program. Additional benefits, such as dental and eye care, may be available.

How to Apply for Florida Medicaid

Florida Medicaid Eligibility Income Chart 2023 : Seniors wishing to apply for Florida Medicaid can do so online via ACCESS. For additional information or application assistance, persons can contact their local ACCESS Service Center. Alternatively, persons may call the Florida Department of Children & Families (DCF) Application Center at 1-866-762-2237.e

Prior to submitting a Medicaid application for long-term care in Florida, it is imperative that seniors are certain that they meet all eligibility requirements. Persons who have income and / or assets in excess of the limit(s) can benefit from Medicaid planning for the best chance of acceptance into a Medicaid program. Learn more about how the Medicaid application process works.

Florida Medicaid Eligibility Test / Pre-Screen for Long Term Care

Our organization has created a simple test for seniors (Americans, 65 and older) to check their eligibility status for Medicaid long term care. This includes questions about the Medicaid candidate’s (and their spouse’s) income and financial resources or “countable assets”. In Medicaid-speak, these are referred to as Medicaid income tests and Medicaid asset tests. This test does not take into consideration the level of care needs of the candidate. It is presumed all persons for whom the form is completed have Medicaid-level care needs for long term care.

Long term care benefits from Medicaid are most commonly provided in a nursing home. However, almost all states also offer “Home and Community Based Services”, which is both medical care and non-medical support services provided to persons living at home, in assisted living residences, memory care communities for persons with Alzheimer’s or in the homes of their loved ones.

IMPORTANT – Our Medicaid eligibility test provides an easy way for seniors to determine if they are immediately eligible for Medicaid. This is NOT an application. Nor, are the results of this test binding. The test is designed as a directional tool to inform seniors if they are immediately eligible or if they need to spend down their income or assets or consult with a Medicaid planning professional to become Medicaid eligible. Every state has different financial criteria for Medicaid eligibility and those criteria change annually. Every effort is made to keep this test up-to-date.

After completing the test, users will be informed of their projected eligibility status (if it can be established). Additionally, users will be informed of the most economic route for them to find assistance qualifying and applying for Medicaid, be that a state agency or private Medicaid planner.

The results of this test are presented as a webpage. Once the user’s browser window is closed, that webpage is no longer available. Therefore, an email address is required so that the user receives a permanent copy of their Medicaid eligibility test results.

Medicaid Eligibility: 2023 Income, Asset & Care Requirements for Nursing Homes & Long-Term Care

Medicaid eligibility is exceedingly complex and to provide the minute details is beyond the mission of this website. There are, however, some over-arching eligibility principles. Medicaid eligibility is determined at many levels, and each state has its own requirements, which change annually. Within each state, each target constituent group has its own requirements. For example, elderly and frail individuals have different eligibility criteria than pregnant women or families with newborn children.

Finally, within the aged and disabled category, Nursing Home Medicaid and Medicaid Waivers providing home and community based services (HCBS) may have different requirements than Regular Medicaid / Aged, Blind and Disabled. Furthermore, each HCBS Waiver may have its own specific eligibility criteria. This webpage focuses on long-term care Medicaid for seniors.

Did You Know? We offer a quick and easy interactive tool to help seniors determine their Medicaid eligibility. Start here.

In the context of the elderly, Medicaid has two types of eligibility requirements: functional and financial. Functionally, individuals must have a medical need. With the exception of Regular Medicaid / Aged, Blind and Disabled Medicaid, individuals usually must require the level of care provided in a nursing home or an intermediate care facility. Financially, Medicaid eligibility looks at both the applicant’s (and sometimes their spouse’s) income and resources (assets).

The information below is generalized. While it is accurate for 2023 for most states, some states do utilize varying criteria. See state specific requirements for long-term care Medicaid.

Florida Medicaid Income Eligibility Criteria

A single individual, 65 years or older, must have income less than $2,742 / month. This applies to nursing home Medicaid, as well as assisted living services and in-home care in states that provide it through HCBS Waivers. Holocaust survivor reparations do not count as income. Income limits for Nursing Home Medicaid and HCBS Waivers is more complicated for married applicants. When only one spouse is an applicant, only the applicant spouse’s income is counted.

This means the income of the non-applicant spouse is not used in determining income eligibility of their spouse, whose income is limited to $2,742 / month. Furthermore, the non-applicant spouse can be allocated some of the applicant’s monthly income. This spousal protection, called a Minimum Monthly Maintenance Needs Allowance (MMMNA), is intended to prevent impoverishment of the non-applicant spouse.

In most states, the maximum amount of income that can be allocated to a non-applicant spouse is $3,715.50 / month. Note that the income of the non-applicant spouse combined with the spousal income allowance cannot exceed $3,715.50 / month. For married couples with both spouses as applicants, each spouse is allowed up to $2,742 / month or a combined income of $5,484 / month.

While Nursing Home Medicaid and HCBS Waivers typically have the same financial eligibility criteria, one can also receive Medicaid in-home care under “Aged, Blind and Disabled” (ABD) Medicaid. ABD Medicaid is commonly called Regular Medicaid or State Plan Medicaid. This type of Medicaid usually has a much lower, more restrictive income limit. Unlike with Nursing Home Medicaid and HCBS Medicaid Waivers, the income of a married couple, even if only one spouse is an applicant, is calculated together.

This means the income of the non-applicant spouse impacts the income eligibility of their spouse. In approximately half of the states, ABD Medicaid’s income limit is $914 / month for a single applicant and $1,371 for a couple. In the remaining states, the income limit is generally $1,215 / month for a single applicant and $1,643 / month for a couple. To be clear, there is no Minimum Monthly Maintenance Needs Allowance for non-applicant spouses of ABD Medicaid beneficiaries.

See state specific Medicaid income guidelines for all 50 states for 2023 or learn more about how Medicaid counts income.

Medicaid candidates whose income exceed these limits might consider working with a Medicaid Planner or reading the section below “Options When Over the Limits”.

Florida Medicaid Asset Requirements

Florida Medicaid Eligibility Income Chart 2023 : The Medicaid asset limit, also called the “asset test”, is complicated. There are several rules of which the reader should be aware before trying to determine if they would pass the asset test.

First, there are “countable assets” and “exempt assets”. An applicant’s home, home furnishings, personal items, and vehicle are generally exempt. However, remaining portions of COVID-19 stimulus checks are countable assets. Second, all of a married couples’ assets, regardless of whose name the asset is in, are considered jointly owned and are counted towards the asset limit.

Third, asset transfers made by the applicant or their spouse up to five years (or 2.5 years in California) immediately preceding their application date for Nursing Home Medicaid or Medicaid Waiver are scrutinized. This is called the Medicaid Look-Back Period. If one has gifted countable assets or sold them under fair market value during this timeframe, a Penalty Period of Medicaid ineligibility will be calculated.

Use our Total Countable Asset & Spend Down Calculator.

A single applicant, aged 65 or older, is permitted up to $2,000 in countable assets to be eligible for Nursing Home Medicaid or a HCBS Waiver. New York is a notable exception allowing $30,182, and is California, allowing up to $130,000. Aged, Blind and Disabled Medicaid usually has the same asset limit. See state specific Medicaid asset limits.

For home exemption, an applicant for Nursing Home Medicaid or a HCBS Waiver must have a home equity interest under a specified amount. Home equity is the fair market value of one’s home minus any debt on the home, such as a mortgage. Equity interest is the portion of the home’s equity value that is owned by the applicant.

In most states, the home equity interest limit is $688,000 or $1,033,000. California is the only state that does not have a home equity interest limit. Furthermore, if the applicant does not live in the home, there must be “Intent to Return” for it to maintain its exempt status. To be clear, there is no home equity interest limit for ABD Medicaid.

Married couples with both spouses applying for Nursing Home Medicaid or a HCBS Waiver are typically allowed $4,000 in countable assets. In many states, married applicants are considered as single applicants and each spouse is permitted up to $2,000 in assets. A big change comes with married couples in which only one spouse is applying for one of these programs. While a husband and wife’s assets are considered jointly owned, the non-applicant spouse is allocated a larger portion of the couple’s assets.

This is called a Community Spouse Resource Allowance (CSRA), and in most states, allows the non-applicant spouse countable assets up to $148,600. This is in addition to the $2,000 the applicant spouse is able to retain in jointly owned assets. The home is excluded from the asset limit, provided the applicant spouse or community spouse (non-applicant spouse) lives in it. If the non-applicant spouse lives in it, there is no equity value limit.

The rules are different for married couples applying for Aged, Blind and Disabled Medicaid. In this case, the couple, regardless of if one or both spouses are applicants, are permitted up to $3,000 as a couple. There is no Community Spouse Resource Allowance permitted.

The complexity of the Medicaid asset test underscores the importance of Medicaid planning, a process by which many families who are over the Medicaid asset limit still manage to become Medicaid eligible. Learn more about what Medicaid planners do. For further information on planning techniques when over the asset limit, read the section below, “Options When Over the Limits”.

Level of Care Requirements | Florida Medicaid Eligibility Income Chart 2023

Florida Medicaid Eligibility Income Chart 2023 : The “level of care” (functional) requirement for long-term care Medicaid differs based on the type of Medicaid program from which a senior is seeking assistance. For nursing home care or for home and community based services via a Medicaid Waiver, the level of care that is provided in a nursing home is generally required.

For Aged, Blind and Disabled (ABD) Medicaid programs that provide in-home care, often an applicant need only require limited personal care assistance. If an applicant does not require long-term care and is only seeking medical coverage via ABD Medicaid, it is only required that the applicant be aged (over 65), blind or disabled. They do not have to have a specific medical condition / functional need.

The level of care requirement for nursing home admission or for assistance via a HCBS Waiver might be referred to in a number of ways depending on one’s state of residence. One might hear it called Nursing Facility Level of Care (NFLOC), Nursing Home Level of Care (NHLOC), or simply Level of Care (LOC). The formal rules to meet the LOC need are state specific.

At a minimum, program participants must require assistance with their Activities of Daily Living (ADLs). These are routine daily activities that are required to live independently and include bathing/grooming, dressing, eating, toileting, transferring (i.e., from a bed to a chair), and mobility. Sometimes a senior’s ability to perform their Instrumental Activities of Daily Living (IADLs) is also considered. IADLs include preparing meals, shopping for essentials, housecleaning, and medication management.

A functional needs assessment is done, usually by a medical professional, to determine one’s level of care needs and their inability to perform ADL’s and / or IADL’s. Learn more about Nursing Facility Level of Care. A medical diagnosis of Alzheimer’s Disease, Parkinson’s Disease Dementia, or a related dementia does not automatically mean an individual will meet Medicaid’s level of care requirements. Typically the accompanying symptoms are adequately severe that persons with these conditions meet the requirements as their conditions progress.

Eligibility by Care Type | Florida Medicaid Eligibility Income Chart 2023

Nursing Home Eligibility

Florida Medicaid Eligibility Income Chart 2023 : Eligibility for Medicaid nursing home care is comprised of financial requirements and care requirements. The financial requirements are comprised of income and asset limits. These are described in detail above. The level of care requirement requires an applicant need the level of care typically provided in a nursing home.

While this may sound obvious, “Nursing Home Level of Care” (NHLOC) is actually a formal designation and requires a medical doctor to make this designation. Furthermore, the rules around what defines NHLOC change in each state. Nursing home care by Medicaid is an entitlement. This means if one meets the financial and level of care requirements, a state must pay for that individual’s nursing home care.

Assisted Living Eligibility

Prior to discussing Medicaid’s eligibility requirements for assisted living / senior living, it is helpful for the reader to understand how Medicaid pays for assisted living. Persons residing in assisted living residences receive assistance from Medicaid either through HCBS Waivers or through the state’s Aged, Blind and Disabled (ABD) Medicaid. HCBS Waivers are designed for persons who require a Nursing Home Level of Care, but prefer to receive that care while living at home or in assisted living.

This may include “memory care”, which is a type of specialized assisted living for persons with Alzheimer’s disease and related dementias. HCBS Waivers will not pay for the room and board costs of assisted living, but they will pay for care costs. Waivers are not entitlements. They are federally approved, state-specific programs that have limited participant slots. Many Waivers, especially those intended to help persons in assisted living, have waiting lists.

To be clear, one can be financially and functionally eligible for an assisted living waiver, but be unable to enroll due to a waiting list. The eligibility criteria for Medicaid assisted living services through a Medicaid HCBS Waiver are generally the same as the eligibility requirements for nursing home care. Candidates must require a “Nursing Home Level of Care” and meet the financial requirements described above.

Aged, Blind and Disabled (ABD) Medicaid provides help for persons in assisted living, but as with Waivers, it will not pay for assisted living room and board, only for care. Nor will ABD Medicaid necessarily pay for ALL the individual’s care needs. The good news about ABD Medicaid (when compared to Waivers) is that ABD Medicaid is an entitlement.

If the applicant meets the eligibility criteria, the Medicaid program must provide them with the assistance they require. ABD Medicaid typically has more restrictive income limits than Medicaid Waivers or nursing home care. However, ABD Medicaid does not typically require that beneficiaries need a “Nursing Home Level of Care”. ABD Medicaid financial eligibility criteria are state-specific. One can view their state’s rules here.

In-Home Care Eligibility | Florida Medicaid Eligibility Income Chart 2023

Florida Medicaid Eligibility Income Chart 2023 : Medicaid beneficiaries can receive assistance in their home through a Home and Community Based Services (HCBS) Waiver or through Aged, Blind and Disabled (ABD) Medicaid. These are two different types of Medicaid programs with varying eligibility requirements.

Waivers, in all 50 states, offer home care as a benefit. Unfortunately, HCBS Waivers are not entitlements. Therefore, being eligible does not necessarily mean one will receive care. It is very likely one will be put on a waiting list for assistance. Waivers generally have the same level of care and financial eligibility criteria as Nursing Home Medicaid. These limits are detailed above.

ABD Medicaid also provides in-home care, and unlike HCBS Waivers, ABD Medicaid is an entitlement. Typically, ABD Medicaid has more restrictive financial eligibility criteria and less restrictive care need requirements than Waivers or Institutional Medicaid. ABD Medicaid eligibility criteria are state-specific. One can see the data for each state here.

Options When Over the Limits

Individuals and couples who are over Medicaid’s income and / or asset limit(s), but still cannot afford their long-term care costs, can still qualify for Medicaid. Medicaid offers different eligibility pathways and planning strategies to become eligible.

Options When Over the Income Limit

Medically Needy Pathway : Medically Needy Medicaid, also called “Share of Cost” Medicaid, is currently available in 32 states and Washington D.C. The Medically Needy Pathway, in brief, considers the Medicaid candidate’s income AND their medical / care costs. If Medicaid finds one’s care costs consumes the vast majority of their income, then Medicaid will allow the individual to become income-eligible as long as their monthly income does not exceed the cost of their long-term care.

States have Medically Needy Income Limits (MNILs), which is the level to which one must “spend down” their monthly income on their care costs to qualify for Medicaid via this pathway. Based on the state, the Medically Needy Income Limit may be called by a different name. For example, in Vermont it is called the Protected Income Level, and in California, it is called a Maintenance Needs Allowance.

Example – John lives in California, has a monthly income of $4,500, and the state’s Maintenance Needs Allowance is $600. He requires 40 hours of home care each week at $25 per hour. His monthly cost of care is $4,000 (4 weeks x 40 hours x $25 = $4,000). Since John’s monthly income is $500 after paying for his home care, and California’s Maintenance Needs Allowance is $600.00, John would be eligible for California Medicaid (Medi-Cal) through the Medically Needy Pathway.

Miller Trusts or Qualified Income Trusts (QITs) | Florida Medicaid Eligibility Income Chart 2023

QITs are a planning strategy for persons who have income over Medicaid’s income limit. In an oversimplified explanation, an applicant’s monthly income in excess of the limit is put into a QIT, no longer counting towards Medicaid’s income limit. The money in the trust, which is managed by someone other than the Medicaid applicant, can only be used for very specific purposes. Examples include paying Medicare premiums and medical expenses that are not covered by Medicaid.

Options When Over the Asset Limit

Florida Medicaid Eligibility Income Chart 2023 : Neither the Medically Needy Pathway nor Qualified Income Trusts can assist Medicaid applicants who are over the asset limit in becoming asset-eligible. However, there are several planning strategies that can assist Medicaid applicants in reducing their countable assets. The simplest is to “spend down” excess assets on care costs.

Use a Spend-Down Calculator to determine the approximate amount of assets one must spend in order to become asset-eligible for Medicaid.

Other options, which are more complicated, include purchasing an Irrevocable Funeral Trust, converting a lump sum of cash into monthly income via annuities, putting assets into Medicaid Asset Protection Trusts, and utilizing the Modern “Half a Loaf” strategy, which combines the use of annuities with gifting assets. Less utilized techniques include Medicaid Divorce and Spousal Refusal.

Furthermore, there are Lady Bird Deeds, which can protect one’s home from Medicaid’s Estate Recovery Program and instead preserve it for family as inheritance. Some of these options violate Medicaid’s Look Back Rule, which inevitably, will result in a Penalty Period of Medicaid ineligibility. It is highly advised that persons over the asset limit consult with a professional Medicaid planner prior to moving forward with these strategies. Find a Medicaid expert.

Medicaid Planning | Florida Medicaid Eligibility Income Chart 2023

Medicaid Planning is a strategy by which persons whose income and / or assets exceed Medicaid’s limit(s) can become Medicaid eligible. A Medicaid expert can assist these persons in re-structuring their finances to help them become eligible. We’ve written extensively about the Pros and Cons of Medicaid Planning and the Different Types of Medicaid Planners. One should also consider reading the New York Times piece, Is Medicaid Planning Ethical? To search for a planner, click here.