How to fill out the W-9 form, w-9 form download, free w-9 form, w-9 instructions, who is required to fill out a w9?, when is a w9 not required, w-9 form trust/estate, Form W-9 Request for Taxpayer Identification Number and Certification, form w-9 instructions, form w-9 PDF 2023, What Is a W-9 Form, do i have to pay taxes if i fill out a w9, w-9 form download, w9 form 2023 pdf, w9 form 2023

What is Form W-9?

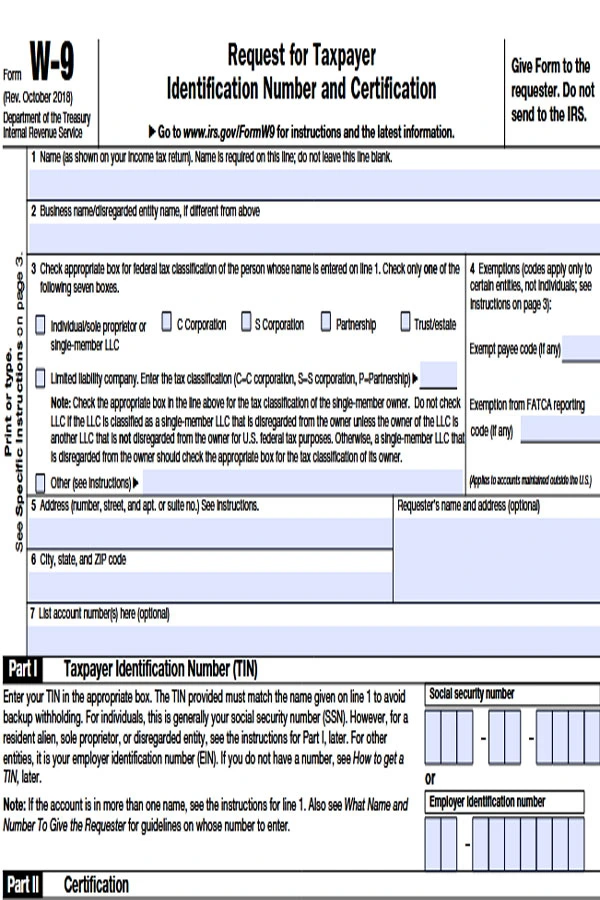

The W-9 form is an Internal Revenue Service (IRS) tax form used to verify an individual’s name, address and taxpayer identification number (TIN) for employment or other income-generating purposes. Verification may be requested for either a person defined as a US citizen or a person defined as a resident alien. The W-9 form is also known as the Request for Taxpayer Identification Number and Certification form.

who is required to fill out a w9? | w9 form 2023 pdf

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) for the person who is required to file the information return with the IRS to report it, for example:

- Income paid to you.

- Real estate transactions.

- Mortgage interest you paid.

- Acquisition or abandonment of secured property.

- Cancellation of debt.

- Contributions you made to an IRA.

form w-9 instructions | w-9 form download PDF

- Section references are to the Internal Revenue Code unless otherwise noted.

- Future developments. For the latest information about developments related to Form W-9 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/FormW9

W-9 Form Download | W-9 Form 2023 PDF Download

form w-9 purpose | w-9 form download PDF

An individual or entity (Form W-9 requester) who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) which may be your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but are not limited to, the following:

- Form 1099-INT (interest earned or paid)

Form 1099-DIV (dividends, including those from stocks or mutual funds) - Form 1099-MISC (various types of income, prizes, awards, or gross proceeds)

- Form 1099-B (stock or mutual fund sales and certain other transactions by brokers)

- Form 1099-S (proceeds from real estate transactions)

- Form 1099-K (merchant card and third party network transactions)

- Form 1098 (home mortgage interest), 1098-E (student loan interest), 1098-T (tuition)

- Form 1099-C (canceled debt)

- Form 1099-A (acquisition or abandonment of secured property)

Use Form W-9 only if you are a U.S. person (including a resident alien), to provide your correct TIN. If you do not return Form W-9 to the requester with a TIN, you might be subject to backup withholding. See What is backup withholding, later.

Who is the provider of W9 form? | w-9 form download

The W-9 form known as Request for Taxpayer Identification Number is one of the forms issued by the US government agency- Internal Revenue Service (IRS), which is responsible for the collection of taxes and enforcement of tax laws.

How do I know I need w9? | w-9 form download

As a small business owner, it’s important to collect a W-9 for any person or entity to whom you pay more than $600 in the tax year. You will use the information you provided on the W-9 to complete Form 1099-NEC, Non-Employee Compensation, or Form 1099-MISC, Miscellaneous Income.

How to Fill Out Form W-9 | w-9 form download

Form W-9 is one of the simplest IRS forms to complete, but if tax forms bother you, all pages of Form W-9 are available on the IRS website. In addition, the form may include a specific set of instructions provided by the IRS.

special rules for partnership Form W-9 | w9 form 2023 pdf

Partnerships carrying on a trade or business in the United States are generally required to pay withholding tax under section 1446 on any foreign partner’s share of taxable income effectively attributable to such business. In addition, in some cases where Form W-9 has not been received, the rules under section 1446 require the partnership to presume that the partner is a foreign person, and pay section 1446 withholding tax.

Therefore, if you are a US person who is a partner in a partnership carrying on a trade or business in the United States, provide Form W-9 to the partnership to establish your US status and your share of partnership income withheld by section 1446. Avoid applying In the cases below, the following individual must provide Form W-9 to the partnership in order to establish its U.S. status and avoid withholding on its allocable share of the net income from the partnership carrying on a trade or business in the United States.

- US In the case of an owner disregarded entity, the disregarded entity’s U.S. the owner, not the entity;

- in the case of a grantor trust with a US grantor or other US owner, generally, the US grantor or other US owner of the grantor trust, not the trust itself; And

- US In the case of a trust (other than a grantor trust), the U.S. Trusts (other than grantor trusts) and not beneficiaries of the trust.

Form W-9 for Foreign Individuals | w9 form 2023 pdf

If you are a foreign person or a US branch of a foreign bank has decided to treat you as a US person, do not use Form W-9. Instead, use the appropriate Form W-8 or Form 8233 (see Public 515, Tax Withholding on Nonresident Aliens and Foreign Entities).

IRS Login | IRS My Account Login & Create Account

Nonresident alien who becomes a resident alien.

Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause.” Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes.

If you are a U.S. resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from U.S. tax on certain types of income, you must attach a statement to Form W-9 that specifies the following five items.

- The treaty country. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien.

- The treaty article addressing the income.

- The article number (or location) in the tax treaty that contains the saving clause and its exceptions.

- The type and amount of income that qualifies for the exemption from tax.

- Sufficient facts to justify the exemption from tax under the terms of the treaty article.

What is FATCA reporting? | w9 form 2023 pdf

The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all United States account holders who are Specified United States Persons. Certain payers are exempt from FATCA reporting. See the FATCA Reporting Code Exemption and Instructions for Requesting Form W-9 later for more information.

Apply For Personal Grants Online For Free | www.grants.gov Apply

updating your information Form W-9 | w9 form 2023 pdf

If you are no longer an exemption recipient and expect to receive reportable payments from this person in the future, you must provide updated information to any person for whom you claim to be an exemption recipient. For example, if you are a C corporation that elects to become an S corporation, or if you are no longer tax exempt, you may need to provide updated information. In addition, if the name or TIN of the account changes, you must submit a new Form W-9; For example, if the grantor of a grantor trust dies.

w9 form penalties 2023 | Form W-9 Request for Taxpayer Identification Number and Certification

Failure to furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. Civil penalty for false information with respect to withholding. If you make a false statement with no reasonable basis that results in no backup withholding, you are subject to a $500 penalty.

Criminal punishment for falsifying information. Knowingly providing a false certificate or endorsement may expose you to criminal penalties including fines and/or imprisonment. Misuse of TIN. If the requester discloses or uses the TIN in violation of federal law, the requester may be subject to civil and criminal penalties.

What is Form W-9 used for? | w9 form 2023 pdf

Form W-9 2023 is used to furnish tax information from one party to another. It is formally a method of collecting personal information, a standard method of disseminating information, and requires the submitter to certify that the information they are providing is accurate. Form W-9 is used to issue specific tax statements to non-employees who have earned some type of pay throughout the year.

Is the W-9 Used for Self-Employed Individuals? | w9 form 2023 pdf

Yes, the W-9 is often used for individuals who are self-employed. But if an employee is an independent contractor, freelancer, or self-employed, Form W-9 must be provided to those from whom you earned more than $600 without being hired as an official employee.

FHA Loan Application | FHA Loan First Time Home Buyer

What if I do not provide Form W-9? | w9 form 2023 pdf

If you choose not to submit Form W-9 or if the information provided is incorrect, 24% will be withheld from future payments received from your client. In addition, there are penalties and charges for willfully failing to provide correct information or misusing the TIN.

How to fill out the W-9 form, w-9 form download, free w-9 form, w-9 instructions, who is required to fill out a w9?, when is a w9 not required, w-9 form trust/estate, Form W-9 Request for Taxpayer Identification Number and Certification, form w-9 instructions, form w-9 PDF 2023, What Is a W-9 Form, do i have to pay taxes if i fill out a w9, w-9 form download, w9 form 2023 pdf, w9 form 2023