HA 539 SP Form PDF Download, How To Fill HA 539 SP Form PDF, HA 539 SP Form, HA 539 SP Form PDF, HA 539 SP Form Download, How To Download HA 539 SP Form, How To Fill Online HA 539 SP Form, HA 539 SP PDF, HA 539 SP Form 2023, HA 539 SP Form Blank, Printable HA 539 SP Form, Social Security HA 539 SP Form, Form HA 539 SP PDF, Form HA 539 SP Download, Fillable HA 539 SP Form

HA 539 SP Form PDF Download – When it comes to navigating the complex world of tax forms, the HA 539 SP form is one that many individuals and businesses may encounter. This form plays a crucial role in the taxation process and is often associated with specific circumstances and requirements. In this comprehensive guide, we will delve into the details of HA 539 SP form, its purpose, and how to fill it out correctly.

What is HA 539 SP Form?

HA 539 SP, also known as the “Application for Determination of Acceptable Risk,” is a tax form primarily used by businesses and individuals who engage in high-risk financial activities or have tax-related concerns. It is most commonly associated with tax compliance and risk assessment, making it a crucial tool for both taxpayers and tax authorities.

When is HA 539 SP Form Required? – HA 539 SP Form PDF 2023

- High-Risk Financial Activities: Individuals or businesses involved in high-risk financial activities such as cryptocurrency trading, offshore investments, or speculative ventures may be required to submit HA 539 SP forms to demonstrate their compliance with tax regulations.

- Tax Audits: Taxpayers facing an audit or tax investigation may be asked to provide this form as part of the documentation required to assess their tax liability and financial risk.

- Appeals and Disputes: In cases of tax disputes or appeals, HA 539 SP forms can be used to provide additional information and evidence related to the disputed tax amounts.

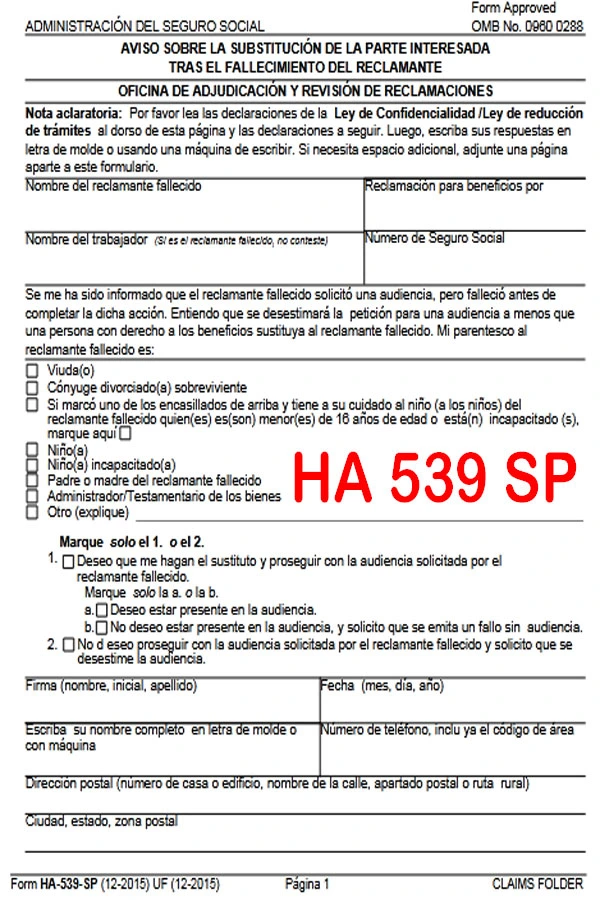

Parts of the HA 539 SP Form PDF Download

The HA 539 SP form typically comprises several sections, each serving a distinct purpose:

- Personal or Business Information: This section requires the taxpayer to provide their name, contact details, and Taxpayer Identification Number (TIN). For businesses, the Employer Identification Number (EIN) is necessary.

- Description of Financial Activities: Here, the taxpayer is expected to provide a detailed description of their high-risk financial activities or tax-related concerns. This section often requires precise and comprehensive information.

- Financial Records and Documentation: Taxpayers may need to attach supporting documentation that substantiates the information provided in the form. This can include bank statements, transaction records, and other relevant financial records.

- Tax Compliance History: A critical part of the HA 539 SP form involves disclosing your tax compliance history, including any past tax disputes, penalties, or interest payments.

- Declaration and Signature: The taxpayer or authorized representative must sign and date the form, certifying the accuracy of the information provided.

Form HA 539 PDF Download

HA-520 Form PDF Download – Request for Review

How To Download HA 539 SP Form PDF 2023

HA 539 SP Form PDF 2023 – PDF Download

How To Fill Out HA 539 SP Form PDF

Filling out the HA 539 SP form accurately is essential to avoid potential issues with tax authorities. Here are some key tips for completing the form:

- Use Legible Handwriting: Ensure that all information provided is legible and neatly written or typed.

- Provide Detailed Descriptions: When describing financial activities, be as specific and comprehensive as possible. Include dates, amounts, and relevant details.

- Attach Supporting Documents: Include all necessary supporting documents that validate the information provided.

- Seek Professional Assistance: If you are unsure about any aspect of the form or its requirements, consider seeking guidance from a tax professional or attorney who specializes in tax matters.

Ha 510 Form PDF Download | How To Fill HA 510 Form

How To Fill CMS-L564 Request For Employment Information PDF

Conclusion – HA 539 SP Form PDF 2023 Download

HA 539 SP Form PDF 2023 Download : The HA 539 SP form plays a pivotal role in tax compliance and risk assessment for individuals and businesses engaged in high-risk financial activities or facing tax-related concerns. By understanding its purpose, parts, and how to correctly fill it out, taxpayers can navigate tax obligations more effectively and ensure compliance with tax regulations. Remember that accuracy and transparency are crucial when dealing with HA 539 SP forms to avoid potential legal issues and penalties.