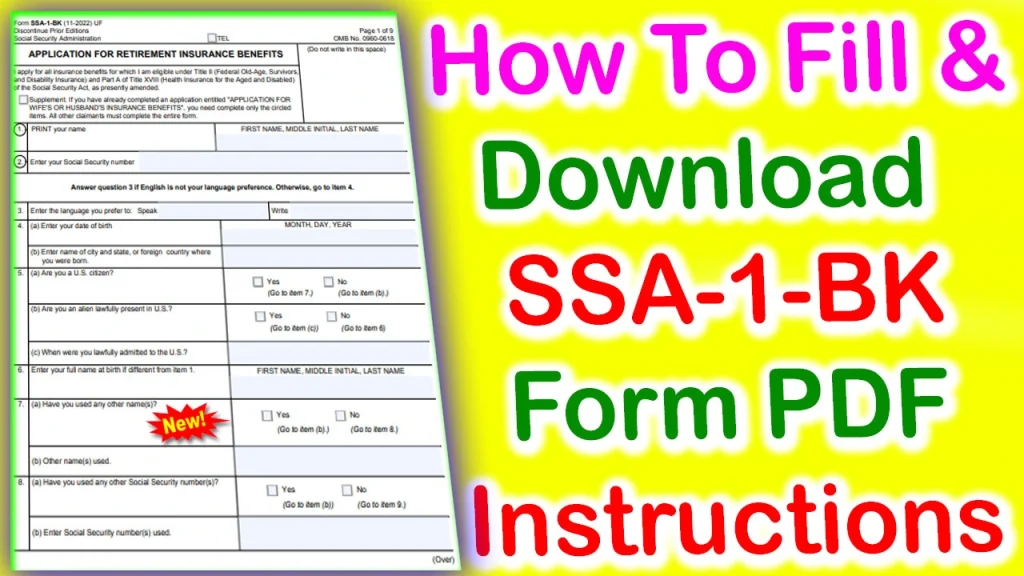

Form SSA-1-BK Application For Retirement Insurance Benefits PDF, SSA-1-BK Form PDF, SSA-1-BK Form PDF Download, Form SSA-1-BK PDF Download, Application For Retirement Insurance Benefits, form ssa-1-bk instructions, Form SSA-11-BK, Form SSA-1-BK PDF Download, How To Download Form SSA-1-BK PDF, How To Fill Form SSA-1-BK PDF, Form SSA-1-BK Fill Online, Form SSA-1-BK Download

SSA-1-BK Application For Retirement Insurance Benefits PDF : As individuals approach retirement age, one of the most critical financial decisions they face is when and how to claim Social Security retirement benefits. The Social Security Administration (SSA) offers a streamlined and convenient way to apply for these benefits through the SSA-1-BK Application for Retirement Insurance Benefits PDF. In this article, we will provide you with a comprehensive guide to understanding and completing this important application.

Form SSA-1-BK Application For Retirement Insurance Benefits PDF

Before delving into the details of the SSA-1-BK application, it’s essential to grasp the concept of Retirement Insurance Benefits (RIB). RIB is a monthly financial assistance program provided by the SSA to eligible retirees who have earned enough Social Security credits through their work history. The amount of your RIB depends on factors such as your earnings history and the age at which you choose to begin receiving benefits.

Who Can Apply for SSA-1-BK Form Retirement Insurance Benefits?

To be eligible for Retirement Insurance Benefits, you must meet the following criteria:

- Age Requirement: Typically, individuals become eligible for RIB at age 62. However, the full retirement age (FRA) varies depending on your birth year. FRA ranges from 65 to 67.

- Earnings History: You must have earned enough Social Security credits during your working years. Credits are based on your annual income, and most individuals need 40 credits (equivalent to 10 years of work) to qualify.

- Citizenship or Eligibility Status: You must be a U.S. citizen or an eligible non-citizen with valid immigration status.

- Not Currently Receiving Certain Benefits: You should not be receiving certain other Social Security benefits, such as disability benefits.

How To Fill Out SS-5-FS Form PDF

How To Fill Form HA 4633 For Claimant’s Work Background

How To Download Form SSA-1-BK Application For Retirement Insurance Benefits PDF

Form SSA-1-BK Application For Retirement Insurance Benefits PDF – Download PDF

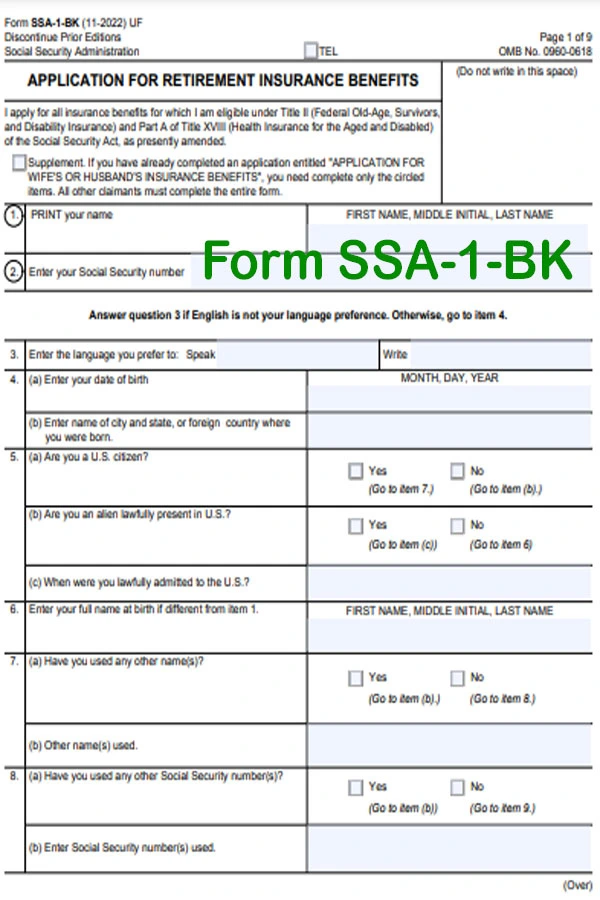

Completing the SSA-1-BK Application For Retirement Insurance Benefits

Now, let’s explore the steps to complete the SSA-1-BK Application for Retirement Insurance Benefits PDF:

- Obtain the Form: You can download the SSA-1-BK form from the official SSA website (www.ssa.gov) or obtain a printed copy from your local Social Security office.

- Gather Required Information: Before starting the application, gather essential documents and information, including your Social Security number, birth certificate, W-2 forms or self-employment tax returns, bank account information for direct deposit, and information about your spouse or ex-spouse if applicable.

- Fill Out the Form: Carefully complete all sections of the SSA-1-BK form, providing accurate and up-to-date information. Pay special attention to the sections regarding your work history and earnings.

- Choose Your Filing Method: You can submit the completed form either in person at your local Social Security office or by mailing it to the SSA. You can also file your application online through the official SSA website.

- Review and Submit: Before submitting your application, review it for accuracy and completeness. Ensure all required documents and information are attached.

- Wait for Processing: After submitting your application, the SSA will review it to determine your eligibility for Retirement Insurance Benefits. This process may take several weeks to months, so be patient.

- Receive Your Decision: Once your application is processed, the SSA will notify you of their decision. If approved, you will receive details about your benefit amount and when you can expect to start receiving payments.

How To Fill Form HA-4632 For Claimant’s Medications

Form HA-4631 PDF Download – Claimant’s Recent Medical Treatment

FAQ’s-SSA-1-BK Application For Retirement Insurance Benefits PDF

Q: What is Form SSA-1-BK?

Ans: Form SSA-1-BK is the official application form used to apply for Retirement Insurance Benefits (RIB) provided by the Social Security Administration (SSA) in the United States.

Q: What are Retirement Insurance Benefits (RIB)?

Ans: Retirement Insurance Benefits (RIB) are monthly financial benefits provided by the SSA to eligible retirees who have earned enough Social Security credits through their work history.

Q: Where can I obtain Form SSA-1-BK?

Ans: You can obtain Form SSA-1-BK by downloading it from the official SSA website (www.ssa.gov) or by visiting your local Social Security office to pick up a printed copy.

Q: What information and documents are needed to complete Form SSA-1-BK?

Ans: To complete the form, you will need essential documents and information such as your Social Security number, birth certificate, W-2 forms or self-employment tax returns, bank account information for direct deposit, and information about your spouse or ex-spouse if applicable.

Q: How can I submit my completed Form SSA-1-BK?

Ans: You can submit the completed form in person at your local Social Security office, mail it to the SSA, or file your application online through the official SSA website.

Q: What is the purpose of reviewing the application before submission?

Ans: Reviewing the application before submission is crucial to ensure accuracy and completeness. It helps avoid delays in processing and ensures that all required documents and information are included.

Q: How long does it take for the SSA to process the Form SSA-1-BK application?

Ans: The processing time for Form SSA-1-BK applications can vary, but it typically takes several weeks to months. It’s important to be patient while waiting for a decision.

Q: What happens after the SSA processes my application?

Ans: After the SSA processes your application, they will notify you of their decision. If approved, you will receive details about your benefit amount and when you can expect to start receiving payments.

HA-4608 Form PDF Download – Waiver Of Appearance Form

How To Fill HA 539 SP Form PDF

Q: Is there a specific age requirement to be eligible for Retirement Insurance Benefits?

Ans: Yes, there is an age requirement. Typically, individuals become eligible for RIB at age 62. However, the full retirement age (FRA) varies depending on your birth year and can range from 65 to 67.

Q: Can non-U.S. citizens apply for Retirement Insurance Benefits using Form SSA-1-BK?

Ans: Yes, eligible non-citizens with valid immigration status can apply for Retirement Insurance Benefits using Form SSA-1-BK, provided they meet all other eligibility criteria.

Conclusion – SSA-1-BK Application for Retirement Insurance Benefits PDF

Applying for Retirement Insurance Benefits through the SSA-1-BK Application for Retirement Insurance Benefits PDF is a critical step in securing financial stability during your retirement years. By understanding the eligibility requirements and completing the application accurately, you can maximize your retirement income and enjoy the benefits you’ve earned through your years of work. Remember to consult with a financial advisor or the SSA if you have any questions or need assistance during the application process, ensuring a smooth transition into your retirement years.