How to Download PTRC Challan, PTRC Challan Download, PTRC Challan Download कैसे करें, PTRC Challan Online Payment, PTRC चालन डाउनलोड कैसे करे, PTRC Challan Tex Slab, PTRC Challan Full Form, PTRC Challan Format, PTRC Challan Download Kaise Kare, PTRC चालन क्या है, PTRC Downlad PDF, PTRC Challan Payment Receipt PDF, What is PTRC, How to Make PTRC Payment Online, PTRC Challan Receipt PDF

PTRC Challan Download:- A tax is collected by the Government of Maharashtra from the citizens on their salary. Which is known as Professional Tax. In which citizens need PTRC Challan receipt after making online payment of tax. About which they are not aware of their PTRC Challan receipt download. That’s why we have told you in this article how to download PTRC Challan, what is PTRC, how to make PTRC online payment and complete information about PTRC Challan full form, purpose, benefits, features etc.

How to Download PTRC Challan 2023: Receipt PDF & Payment

Friends, if you are still unaware of the name of PTRC Challan, then tell you, many different types of taxes are taken in India, out of which there is a type of tax deducted on the salary of government and non-government employees in Maharashtra, in which you have to How much will have to be paid in PTRC Challan. It depends on your salary.

After this citizens need to download their PTRC Challan after paying tax because you need PTRC Challan to file tax return. If you do not know how to download PTRC Challan?, then in this article you have been told step by step the process of downloading PTRC Challan. With which you will be able to easily download PTRC Challan online from mobile phone.

TAFCOP Portal: tafcop.dgtelecom.gov.in Login, Check Active SIM Status

What is PTRC? | PTRC Tax Kyaa Hai?

In our country India, citizens have to pay many different taxes, in which if you are from the state of Maharashtra, then you have to pay PTRC tax. Which is deducted from the salary of the citizens. That is, if your salary is more than Rs 7500, then you will have to pay PTRC tax to the Government of Maharashtra.

Now the facility has been started by the Government of Maharashtra on the online portal for PTRC online payment and PTRC Challan download. So that now citizens will not have to visit any office to get their PTRC Challan receipt. Because by visiting the portal, the city itself can download the PTRC Challan and get the province out.

Overview PTRC Challan Download

| Post Name | Professional tax challan Maharashtra download PDF |

| Objective | Providing the facility of online challan download to the employees |

| PTRC Full Form | Professional Tax Registration Certificate |

| Download Method | Online Mode |

| Official Website | mahagst.gov.in |

| Update | 2023 |

AIMS Portal 2023 RESS Salary Slip For Railway Employee, Login & Registration

PTRC Tax Slab | Professional tax challan Maharashtra download PDF

Different slabs have been prepared by the government for PTRC Tax i.e. Professional Tax, which is as follows: –

- PTRC Tax depends on your salary, in which if you are a man and your salary is Rs 7500 and if you are a woman and your monthly salary is Rs 10000, then you will not have to pay PTRC Tax.

- PTRC Tax in which if the monthly salary of a man is more than Rs 7500 and if you are a woman and your monthly salary is more than Rs 10000, then you will have to pay a monthly tax of Rs 175.

- Apart from this, if the salary of a citizen is more than Rs.10,000. So in such a situation that person will have to pay professional tax of Rs.2500 every year.

- If a person delays in paying this tax, then that person will have to pay a fee of up to Rs 1000 separately. This penalty depends on your salary.

SECR Portal Pay Slip 2023 Download

How to Download PTRC Challan 2023 | Professional tax challan Maharashtra Download PDF

- To download PTRC Challan, you must first go to the official website of Goods and Services Tax Government of Maharashtra.

- After this, the home page of the website will open in front of you. Which will appear on your screen like this.

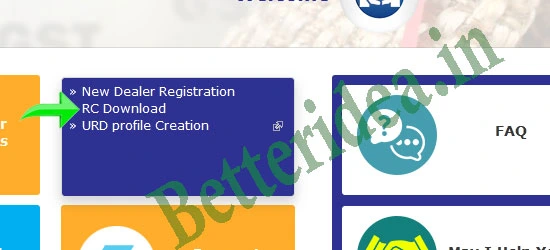

- You have to go to the link of Other Acts Registration given in the home page of the website, in which you have been given different options.

- From which you have to click on the link of “RC Download”, after that a new page will open in front of you. Which will appear on your screen like this.

- In the next new page, you have to enter the PAN card number or TIN number and click on the “Get Status” button given next to it.

- After this, you can check PTRC Challan in the next page and download PTRC Challan.

How to Make PTRC Payment Online ? | PTRC Challan Online Payment

- The document required for PTRC is to visit the official website of Goods and Services Tax Government of Maharashtra.

- After this the home page of the website will open in front of you. Which will appear on your screen like this.

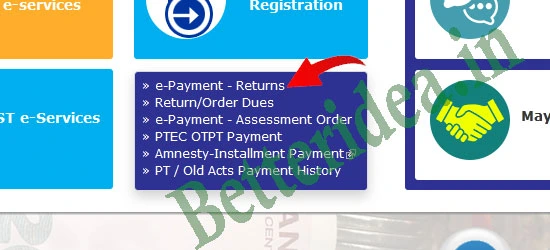

- You have to click on the link of “e-payment” in the next page. In this you have been given different options.

- From which you have to click on the link of “e-Payment – Returns”, after that a new page will open in front of you. Which will appear on your screen like this.

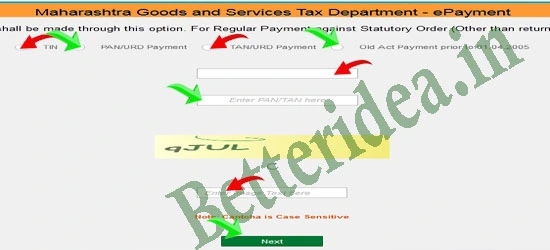

- To make PTRC Payment Online here, you have to select a document and enter its name below.

- And you have to click on the Next button given below, after that you will be able to do PTRC Payment Online.

Note:- Regular Payment related to Returns shall be made through this option. For Regular Payment against Statutory Order (Other than return) use e-Payment Assessment Order.

What is the procedure to make payment?

- go to www.mahagst.gov.in

- put your mouse point on e-Payment. The tile will flip and option will be displayed.

- Select appropriate option

- Enter Your TIN, captcha and Press Next button

- Select Act, form ID, Financial Year, Period and Location. Enter the amount and then press Proceed for Payment.

- Agree to refund policy by clicking radio button and then select payment gateway and click on Proceed.

- Draft chalan will be displayed

- Click on Make Payment

- Payment gateway page will be displayed Select Bank in which you hold net

- banking account.

- Click on Proceed for Payment

- Gateway will redirect you to bank web-page

- enter your login credentials of net banking and make payment.

- Final receipt in MTR-6 will be generated.

- Stepwise detail process is given in the Trade Circular 48T of 2017

- RTE Maharashtra Lottery Result 2023 Direct Link

- MH Ration Card Online Apply

- MH Shramik Card Online Apply

- Maharashtra Labour Card List Kaise Dekhe

Documents required for PTRC

- pan card

- Aadhar card

- passport size photo

- canceled check

- electricity bill

- business information

- number of employees

- email id

- mobile number

Who gets PTRC exemption?

Friends, some citizens are exempted from PTRC tax by the government, but there are different rules for this, which are as follows: –

- In the event of a person being mentally and physically disabled, they are exempted from PTRC tax.

- Citizens whose age is more than 65 years are given exemption in tax.

- Airforce, Army and Navy personnel can get exemption in PTRC tax.

How can I file the PTRC Return ?

- The employer shall use his login credentials for using e-services of

- www.mahagst.gov.in

- Click on Returns

- Select “Return Submission Other Than VAT/CST”

- Select Act then press Next

- Select “Return Type” and press Next

- Select Month and press Next’

- Select File by clicking Browse button and then Click OK

- Click on “Upload file“

- Draft Return will be shown

- Click on “Submit” and return will get uploaded and final receipt with the return will be generated.

What is the process to generate the challan if I am unable to take print out at the time of payment?

- After login to the departments web-site www.mahagst.gov.in user can reprint the chalan.

- by path Payments >> Pending Transaction History >> View Chalan. A PDF of chalan.

- will get generated when the user clicks on “View Chalan”.

- If the status of the payment is not updated by the bank on real time basis, the status of the chalan is shown as “Get Status”. User can obtain the real time status by clicking.

- “Get Status”. If the status of the payment is updated as successful from bank then “Get.

- Status” will be converted into “View Chalan”. A PDF of chalan will get generated

- when the user clicks on “View Chalan”.

FAQ PTRC Challan Download PDF Maharashtra

Q:- How to Download PTRC Challan?

Ans:- You can download PTRC Challan by entering your PAN card or TIN number on the link of RC Download given in the option of “Other Acts Registration” on the official website of Maharashtra Goods and Services Tax.

Q:- How to make PTRC Challan online payment?

Ans:- State employees can make PTRC Challan Payment online by entering their PAN card number on the link of e-Payment-Returns given in the option of “e-payment” on the official website of Goods and Services Tax.

Q:- Which forms to be used for applying PTEC and PTRC. What is the method of application?

Ans:- The person who is liable to obtain PTEC shall apply in Form II and an employer who is liable to obtain PTRC shall apply in Form I. Both the applications shall be made online on Maharashtra Goods and Services Tax Department’s (MGSTD) web-site www.mahagst.gov.in.

Q:- PTRC Challan ऑनलाइन पेमेंट कैसे करें?

Ans:- राज्य के कमर्चारी Goods and Services Tax की ऑफिसियल वेबसाइट पर ” e-payment ” के विकल्प में दिए गए e-Payment – Returns के लिंक पर अपना पेन कार्ड नंबर डालकर के PTRC Challan Payment ऑनलाइन कर सकते है.

Q:- PTRC Challan Download कैसे करें?

Ans:- आप महाराष्ट्र Goods and Services Tax की ऑफिसियल वेबसाइट पर ” Other Acts Registration ” के विकल्प में दिए गए RC Download के लिंक पर अपने पेन कार्ड या टिन नंबर डालकर के PTRC Challan Download कर सकते है.

Q:- PTRC फुल फॉर्म क्या है?

Ans:- PTRC का पूरा नाम यानि फुल फॉर्म :- Professional Tax Registration Certificate.

प्रशन:- PTRC क्या है?

Ans:- यह एक टैक्स है जो महाराष्ट्र सरकार द्वारा राज्य में सरकारी और गैर कमचारियो से उनकी सैलरी पर वसूला जाता है. जिसमे यह पुरुष 7500 और महिला 10,000 से अधिक वेटेन होने पर लागु होता है.

प्रशन:- PTRC कितनी सैलरी होने पर लगता है?

Ans:- मासिक सैलरी जिसमे अगर पुरुष की सैलरी 7500 से अधिक और महिला की सैलरी 10,000 रुपए से अधिक है तो ऐसे में उन्हें हर महीने सैलरी में से 175 रुपए का टैक्स देना होगा.

प्रशन – Professional tax challan Maharashtra Download PDF ?

Ans:- आप महाराष्ट्र Goods and Services Tax की ऑफिसियल वेबसाइट पर ” Other Acts Registration ” के विकल्प में दिए गए RC Download के लिंक पर अपने पेन कार्ड या टिन नंबर डालकर के Professional tax challan Maharashtra Download PDF कर सकते है.

दोस्तों आपको इस आर्टिकल में How to Download PTRC Challan, PTRC Challan Download, PTRC Challan Download कैसे करें, PTRC Challan Online Payment, PTRC चालन डाउनलोड कैसे करे, PTRC Challan Tex Slab, PTRC Challan Full Form, PTRC Challan Format, PTRC Challan Download Kaise Kare, PTRC चालन क्या है, PTRC Downlad PDF, PTRC Challan Payment Receipt PDF, What is PTRC, How to Make PTRC Payment Online, PTRC Challan Receipt PDF से जुडी जानकारी को दिया गया है अगर आपको इस आर्टिकल में दी गई जानकारी अच्छी लगी है तो इस पोस्ट को अपने सभी दोस्तों के साथ जरुर शेयर करें.