Alabama Medicaid Income Limits 2023, alabama medicaid income limits 2023 family of 5, Alabama medicaid income limits 2023 for seniors, Alabama medicaid income limits 2023 family of 4, medicaid eligibility income chart 2023, Alabama medicaid income limits 2023 child, alabama medicaid for adults, qmb income limits 2023 alabama, allkids al income limits 2023, Alabama Medicaid Income Limit 2023

Alabama Medicaid Income Limits 2023

Alabama Medicaid Long-Term Care Definition

Medicaid is a health insurance program for low-income individuals of all ages. While the program provides coverage for diverse groups of Alabama residents, the focus of this page is on Medicaid eligibility for Alabama elders, aged 65 and over. Specifically, long-term care is covered. In addition to nursing home care and assisted living services, Alabama Medicaid pays for many non-medical support services that help frail seniors remain living in their homes. There are three categories of Medicaid long-term care programs for which AL seniors may be eligible.

1) Institutional / Nursing Home Medicaid – This is an entitlement program; anyone who meets the requirements will receive assistance. Benefits are provided in nursing home facilities.

2) Medicaid Waivers / Home and Community Based Services (HCBS) – These are not entitlement programs; there are a limited number of enrollment slots and waiting lists may exist. Intended to prevent and delay the need for nursing home admissions, benefits are provided at home, adult day care, or in assisted living.

3) Regular Medicaid / Medicaid for Elderly and Disabled (E&D) – This is an entitlement program; anyone who is eligible will receive services. Various long-term care benefits, such as personal care assistance or adult day care, may be available.

Medicaid is jointly funded by the state and federal government. However, it is administered by the state through the Alabama Medicaid Agency.

Alabama Medicaid Income Limits 2023

| 2023 Alabama Medicaid Long-Term Care Eligibility for Seniors | |||||||||

| Type of Medicaid | Single | Married (both spouses applying) | Married (one spouse applying) | ||||||

| Income Limit | Asset Limit | Level of Care Required | Income Limit | Asset Limit | Level of Care Required | Income Limit | Asset Limit | Level of Care Required | |

| Institutional / Nursing Home Medicaid | $2,742 / month* | $2,000 | Nursing Home | $5,484 / month ($2,742 / month per spouse)* | $4,000 ($2,000 per spouse) | Nursing Home | $2,742 / month for applicant* | $2,000 for applicant & $148,620 for non-applicant | Nursing Home |

| Medicaid Waivers / Home and Community Based Services | $2,742 / month† | $2,000 | Nursing Home | $5,484 / month ($2,742 / month per spouse)† | $4,000 ($2,000 per spouse) | Nursing Home | $2,742 / month for applicant† | $2,000 for applicant & $148,620 for non-applicant | Nursing Home |

| Regular Medicaid / Medicaid for Elderly and Disabled | $934 / month | $2,000 | Help with ADLs | $1,391 / month | $3,000 | Help with ADLs | $1,391 / month | $3,000 | Help with ADLs |

*All of a beneficiary’s monthly income, minus a Personal Needs Allowance of $30 / month, Medicare premiums, and potentially a Monthly Maintenance Needs Allowance for a non-applicant spouse, must go towards nursing home costs.

†Based on one’s living setting, a beneficiary may not be able to keep monthly income up to this level.

medicaid eligibility income chart alabama

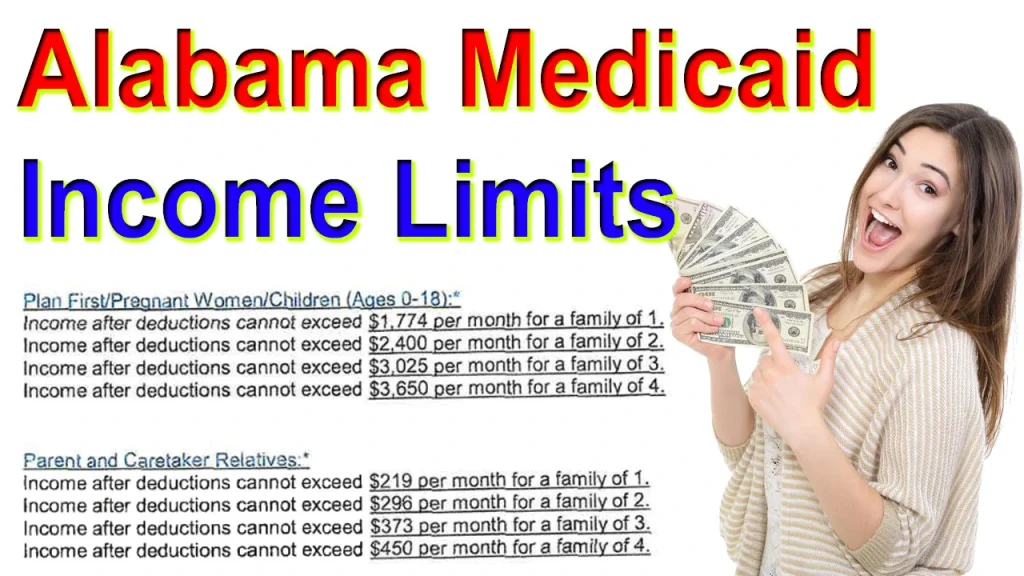

Plan First/Pregnant Women/Children (Age 0-18):

- Income after deductions cannot exceed $1,774 per month for a family of 1 person.

- Income after deductions cannot exceed $2,400 per month for a family of 2.

- Income after the deduction cannot exceed $3,025 per month for a family of 3.

- Income after the deduction cannot exceed $3,650 per month for a family of 4.

Parents and Caregiver Relatives | Alabama Medicaid Income Limits 2023

- Income after the deduction for a one-person household cannot exceed $219 per month.

- Income after the deduction cannot exceed $296 per month for a family of 2.

- Income after the deduction cannot exceed $373 per month for a family of 3.

- The post-deduction income for a family of 4 cannot exceed $450 per month.

(Please refer to the Pregnant Women, Plan First, Children and Parents and other Caregiver Relatives programs (Pre in SOBRA and MLIF) eligibility for pregnant women/children/parents and caregivers of relatives See requirements) Handout for family sizes over 4.)

Note: The above amount is based on the 146% Federal Poverty Level (Amount includes 5% FPL includes neglect)

Note: The above amount is based on the 18% Federal Poverty Level (Amount includes 5% FPL includes neglect)

alabama medicaid income limits 2023 pdf download

Alabama Medicaid Income & Asset Limits for Eligibility

The three categories of Medicaid long-term care programs have varying financial and medical (functional) eligibility requirements. Further complicating financial eligibility are the facts that the requirements change annually, vary with marital status, and that Alabama offers multiple pathways towards Medicaid eligibility.

Alabama Food Stamp Income Limit 2023

Simplified Eligibility Criteria: Single Applicant for Nursing Home Care

Alabama seniors must be financially and medically eligible for long-term care Medicaid. They must have limited income, limited assets, and a medical need for care. A single individual applying for Nursing Home Medicaid in 2023 in AL must meet the following criteria: 1) Have income under $2,742 / month 2) Have assets under $2,000 3) Require the level of care provided in a nursing home facility.

The table below provides a quick reference to allow Alabama seniors to determine if they might be immediately eligible for long-term care from a Medicaid program. Alternatively, one can take the Medicaid Eligibility Test. IMPORTANT: Not meeting all of the criteria does not mean one is ineligible or cannot become eligible for AL Medicaid. More.

Income Definition & Exceptions

Countable vs. Non-Countable Income

Nearly any income from any source that a Medicaid applicant receives is counted towards Medicaid’s income limit. This includes employment wages, alimony payments, railroad retirement, black lung, pension payments, Social Security Disability Income, Social Security Income, IRA withdrawals, and stock dividends. Holocaust restitution payments are an exception and do not count as income.

Treatment of Income for a Couple | Alabama Medicaid Income Limits 2023

When only one spouse of a married couple applies for Nursing Home Medicaid or a Medicaid Waiver, only the income of the applicant is counted. This means the income of the non-applicant spouse is disregarded and does not impact their spouse’s income eligibility. The non-applicant spouse, however, may be entitled to a Minimum Monthly Maintenance Needs Allowance (MMMNA) from their applicant spouse. This is a Spousal Impoverishment Rule and is the minimum amount of monthly income to which a non-applicant spouse is entitled.

In 2023, the MMMNA in AL is $2,465 / month (eff. 7/1/23 – 6/30/24). If a non-applicant spouse has monthly income under this amount, income can be transferred to them from their applicant spouse to bring their monthly income up to this level. If the non-applicant spouse has income equivalent to $2,465 / month or more, the applicant spouse cannot transfer any monthly income to the non-applicant spouse.

Income is counted differently when only one spouse applies for Regular Medicaid / Medicaid for Elderly and Disabled; the income of both the applicant spouse and non-applicant spouse is calculated towards the income eligibility of the applicant. Furthermore, there is no Monthly Maintenance Needs Allowance for a non-applicant spouse. More on how Medicaid counts income.

Alabama Food Stamp Eligibility 2023

EBT Card Issuance Tracking – Track My EBT Card In The Mail

Asset Definition & Exceptions | Alabama Medicaid Income Limits

Countable vs. Non-Countable Assets

The value of countable assets are added together and are counted towards Medicaid’s asset limit. Examples include cash, stocks, bonds, investments, promissory notes, bank accounts (credit union, savings, and checking), any remaining funds from Covid-19 stimulus checks, and real estate in which one does not reside. There are also many assets that Medicaid does not count; they are exempt.

The combined face value of life insurance policies, in 2023, are exempt up to $5,000. Prepaid burial contracts and burial funds are also exempt up to $5,000. However, the exemption amount for burial funds is decreased by the face value of one’s life insurance policies. Other exemptions include personal belongings, such as clothing, household furnishings, an automobile, and generally one’s primary home.

Home Exemption Rules

For home exemption, the Medicaid applicant must live in their home or have Intent to Return, and in 2023, their home equity interest must be no more than $688,000. Home equity is the value of the home, minus any outstanding debt against it. Equity interest is the amount of the home’s equity that is owned by the applicant. Note that there is no home equity interest limit for Regular Medicaid applicants. Furthermore, one’s home is automatically exempt, regardless of any other circumstances, if their spouse lives in it.

While one’s home is usually exempt from Medicaid’s asset limit, it is not exempt from Medicaid’s Estate Recovery Program. Following a long-term care Medicaid beneficiary’s death, Alabama’s Medicaid agency attempts reimbursement of care costs through whatever estate of the deceased still remains. This is often the home. Without proper planning strategies in place, the home will be used to reimburse Medicaid for providing care rather than going to family as inheritance.

Treatment of Assets for a Couple

All assets of a married couple are considered jointly owned. This is true regardless of the long-term care Medicaid program for which one is applying and regardless of if one or both spouses are applicants. However, a Spousal Impoverishment Provision permits the non-applicant spouse of a Medicaid Nursing Home or Waiver applicant a Community Spouse Resource Allowance (CSRA).

In 2023, the CSRA allows the community spouse (the non-applicant spouse) to retain 50% of the couple’s assets, up to a maximum of $148,620. If the non-applicant’s share of the assets falls under $29,724, 100% of the assets, up to $29,724 can be retained by the non-applicant. Note that there is no CSRA for a non-applicant spouse of a Regular Medicaid applicant.

Medicaid’s Look-Back Rule | Alabama Medicaid Income Limits 2023

It is vital that one does not give away assets or sell them for less than fair market value within 60 months of applying for Nursing Home Medicaid or a Medicaid Waiver. This is because Alabama has a Medicaid Look-Back Period that immediately precedes one’s application date. During this 5 year period, the Medicaid agency scrutinizes all asset transfers. If assets have been transferred for under fair market value, a Penalty Period of Medicaid ineligibility will be calculated.

Persons sometimes mistakenly think that the U.S. Federal Gift Tax Rule extends to Medicaid eligibility. In 2023, this rule allows individuals to gift up to $17,000 per recipient without filing a gift tax return. Gifting under this rule violates Medicaid’s Look-Back Period. There is no Look-Back Period for Regular Medicaid.

Medical / Functional Need Requirements

An applicant must have a functional need for long-term care Medicaid. For Nursing Home Medicaid and Medicaid Waivers, a Nursing Facility Level of Care (NFLOC) is required. Furthermore, certain benefits may have additional eligibility requirements specific to the particular benefit. For example, for a Waiver to pay for home modifications, an inability to safely live at home without modifications may be required. For long-term care services via the Regular Medicaid program, a functional need with the Activities of Daily Living (ADLs) is required, but a NFLOC is not necessarily required.

How To Apply For Food Stamps (SNAP benefits)

Qualifying When Over the Limits

For Alabama elderly residents (aged 65 and over), who do not meet the financial eligibility requirements above, there are other ways to qualify for Medicaid.

Qualified Income Trusts (QIT’s) | Alabama Medicaid Income Limits 2023

Also called Miller Trusts or Qualifying Income Trusts, QITs are for Nursing Home Medicaid and Medicaid Waiver applicants who are over the income limit, but still cannot afford to pay their cost of long-term care. This type of trust allows Alabama residents to become income-eligible, as money deposited into this type of irreversible trust does not count towards Medicaid’s income limit. Irreversible means that the terms of the trust cannot be changed or canceled.

Overly simplified, income over the Medicaid limit is deposited into the trust in which a trustee has legal control. Trust funds can only be used for very specific purposes, such as paying long-term care services / medical expenses accrued by the Medicaid enrollee. Furthermore, the state of Alabama Medicaid authorities must be listed as the remainder beneficiary. This means the state will receive the remaining funds in the account, up to the amount the state paid for care, after the death of the Medicaid recipient.

Asset Spend Down | Alabama Medicaid Income Limits 2023

Seniors who have assets over Medicaid’s limit can “spend down” assets and become asset eligible. This can be done by spending excess assets on non-countable ones. Examples include making home modifications (addition of a first floor bedroom, wheelchair ramps, roll-in showers, pedestal sinks, and stair lifts), vehicle modifications (wheelchair lifts, adaptive control devices, and floor modifications to allow one to drive from a wheelchair), prepaying funeral and burial expenses, and paying off debt.

Remember, Medicaid has a Look-Back Period in which past asset transfers are reviewed for a period of 60-months preceding one’s Medicaid application date. Violating this rule by gifting assets or selling them under fair market value results in a period of Medicaid ineligibility. It is recommended one keep documentation of how assets were spent as proof this rule was not violated.

Note : Our Spend Down Calculator can assist persons in determining if they might have a spend down, and if so, provide an estimate of the amount.

USDA 502 Loan Application & Eligibility Requirements

Medicaid Planning | Alabama Medicaid Income Limits 2023

The majority of persons considering Medicaid are “over-income” and / or “over-asset”, but they still cannot afford their cost of care. For these persons, Medicaid planning exists. By working with a Medicaid Planning Professional, families can employ a variety of strategies to help them become Medicaid eligible, as well as to protect their home from Medicaid’s Estate Recovery Program.

Specific Alabama Medicaid Programs

Like all states, Alabama Medicaid pays for nursing home care for state residents who are medically and financially eligible for such care. AL Medicaid also offers Medicaid programs for seniors who require nursing home level care or have slightly lesser care requirements and do not wish to reside in a nursing home. These programs provide care at home or “in the community”.

Alabama Elderly and Disabled Waiver (E&D) –

Assists seniors in living in the community by providing benefits that promote independent living, such as meal delivery, homemaker services, personal care assistance, and adult day health. Program participants have the option to self-direct their own care services via the Personal Choices Program. Participants are able to hire, train, manage, and even fire, their own caregivers, including family members. A waiting list for services via the E&D Waiver may exist.

Alabama SAIL Waiver | Alabama Medicaid Income Limits 2023

The State of Alabama Independent Living Waiver is intended to delay or prevent nursing home placement, or assist with the transition of institutionalization back into the community, of disabled individuals and seniors who meet the medical qualification. Home modifications, assistive technology, personal assistance, and other benefits are available. Program participants can hire their own caregiver, including relatives, via an option called Personal Choices.

Alabama Community Transition Waiver (ACT) –

Assists nursing home residents with transitioning back to living in their home or the home of a family member. Program participants must require a level of care consistent to that which is provided in a nursing home residence. Benefits include home modifications, respite care, personal emergency response systems, companionship services, and adult day care.

Program of All-Inclusive Care for the Elderly (PACE) –

The benefits of Medicaid, including long-term care services, and Medicare are combined into one program. Additional benefits, such as dental and eye care, may be available.

How to Apply for Alabama Medicaid

For more information about Medicaid or to apply for benefits, be that Regular Medicaid, Nursing Home Medicaid, or a Medicaid Waiver, one can call Alabama Medicaid at 1-800-362-1504. One can contact their local district Medicaid office for assistance. One’s local Area Agency on Aging office may also be helpful. Unfortunately, there is not an option for elderly and disabled AL residents to apply online. Instead, an application should be submitted to one’s district Medicaid office.

It is vital that Alabama Medicaid applicants be certain that all eligibility requirements are met prior to applying for benefits. Elderly AL residents who are over the income and / or asset limit(s), or are unsure if they are, should strongly consider Medicaid planning for the best chance of acceptance into a Medicaid program. Familiarizing oneself with general information about the long-term care Medicaid application process can be helpful.